Introduction: The Audit Risk Doesn’t End at the Port 🚨

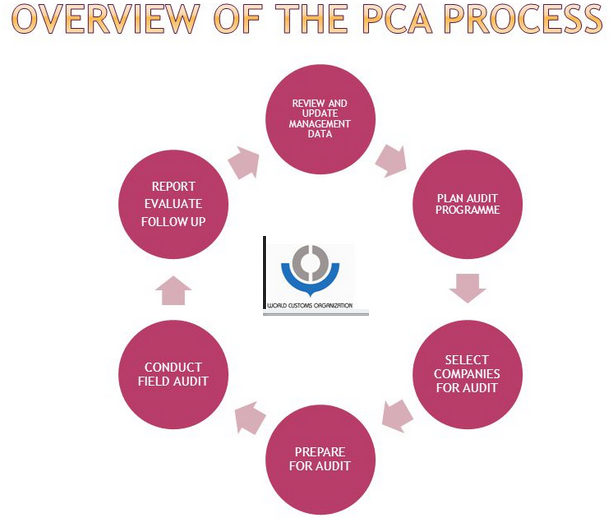

For many importers, the customs process seems complete once the cargo is physically cleared from the port. However, the true risk often begins after delivery. Indonesian Customs authorities heavily rely on Post-Clearance Audits (PCA) to scrutinize import transactions up to two years retrospectively.

A PCA can result in massive financial penalties, back taxes, and fines if non-compliance is found. These audits are not random; they are initiated based on specific, automated red flags triggered by your import data.

As your trusted Kepatuhan Logistik and Freight Forwarding partner, M2B has identified the 5 most common flags that make Indonesian importers a primary target for Customs Audits. Learn to spot and eliminate these risks proactively.

5 Common Red Flags That Trigger a Post-Clearance Audit (PCA) 🚩

1. Consistent Use of High-Risk HS Codes 🎯

Customs maintains a list of High-Risk HS Codes—those with a wide range of potential applications or where there is a significant disparity between the highest and lowest possible duty tariffs.

- The Flag: Consistently classifying goods under the lowest possible tariff within that High-Risk HS Code, or frequent re-classification without justification.

- The Audit Focus: Customs suspects that the importer deliberately chose the lower tariff code to minimize Bea Cukai duties and taxes, even if the goods might fit a higher-duty code based on their primary function.

- Mitigation: Always obtain a Binding Classification Information (ICB/PKB) for complex or new goods. Document the technical justification for your chosen HS Code meticulously.

2. Discrepancy Between Declared Value and Market Value (Under-Valuation) 📉

Customs systems are advanced; they track the valuation of similar goods imported by other companies. Significant deviations trigger an immediate red flag.

- The Flag: Declaring a Customs Value (CIF/FOB) that is significantly lower (e.g., 20% or more) than the average price of identical or similar goods in the market.

- The Audit Focus: Customs will investigate valuation methods used. If the declared value is deemed too low, they will reassess the value (known as Nilai Pabean) and issue a penalty based on the underpaid duties.

- Mitigation: Retain all Trade Finance documents, payment slips, and contracts with your supplier to legally support your declared value. Avoid using non-compliant All-In services that hide the true value.

3. Frequent Customs Fines and Minor Non-Compliance Incidents 📄

Even minor offenses—like late submission of documents or small penalties—create a negative compliance history that feeds the audit algorithm.

- The Flag: Accumulating minor administrative fines, frequent use of the Red Channel in the past, or delays in submitting mandatory documents (PIB, PEB).

- The Audit Focus: A history of non-compliance suggests systemic weakness in the importer’s internal processes and is a predictor of larger financial errors.

- Mitigation: Work with a disciplined Freight Forwarding partner (M2B) that prioritizes timely and accurate submission of all documentation, minimizing administrative errors.

4. Utilization of Tax Incentives or Free Trade Agreements (FTA) 📜

While utilizing FTAs (like the ASEAN-China FTA) is legal and encouraged, it puts a high burden of proof on the importer.

- The Flag: Routinely claiming 0% duty rates under FTAs (e.g., using a Form E from China) without flawless accompanying documentation (Certificate of Origin).

- The Audit Focus: Customs often investigates the validity of the Certificate of Origin or the proper classification of the goods under the preferential trade agreement rules.

- Mitigation: Ensure the Certificate of Origin is valid, issued by the correct authority, and the product meets the Rules of Origin (ROO). Maintain records demonstrating the goods’ origin.

5. Inconsistency Between Import Volume and Business Activity 📈

Customs monitors whether your import activities match the scale and type of your declared business (based on your NIB/API).

- The Flag: A small, newly established company suddenly importing large volumes of high-value goods, or importing goods that do not align with its registered business classification (e.g., a software company importing heavy machinery).

- The Audit Focus: Customs suspects the company may be acting as a conduit for other, non-compliant parties or engaging in activities outside its license.

- Mitigation: Ensure your business license (NIB) accurately reflects the types of goods you import. Maintain clear records of end-users for all large or sensitive import volumes.

📰 Current Spotlight: Digitalization & Predictive Auditing 💻

Indonesian Customs is continuously enhancing its digital tools. The use of data analytics and machine learning now allows the system to instantly compare your current import declaration against historical data, industry benchmarks, and even satellite intelligence. This shift to Predictive Auditing means that your data is flagged before an auditor even looks at it. Proactive Customs Audit preparation, rather than reactive response, is the only sustainable strategy for 2025.

Source: Indonesian Customs Digital Transformation Report, 2024 | Read More: [https://www.google.com/search?q=indonesia+customs+predictive+auditing+2024]

Conclusion: M2B—Your Shield Against Customs Audit Risks ✅

Post-Clearance Audits are a persistent threat in Indonesian trade, but they are manageable. By eliminating these 5 common red flags—focusing on accurate valuation, meticulous HS Code classification, and flawless documentation—you can significantly reduce your audit exposure and ensure long-term Import Compliance.

M2B acts as your compliance shield, providing the expertise, document review, and strategic advice to navigate the complexities of Bea Cukai and minimize your risk exposure from the initial Freight process to the end of the audit window.

Ready to Fortify Your Import Compliance and Avoid Customs Fines? Contact M2B Now! 🤝

Secure your business from retrospective audits. Get a compliance risk assessment today.

- Phone / WhatsApp: +62 812 6302 7818

- Email: info@m2b.co.id

- Website: www.m2b.co.id