Why Indonesia is a Goldmine for Foreign Exporters in 2025 🚀

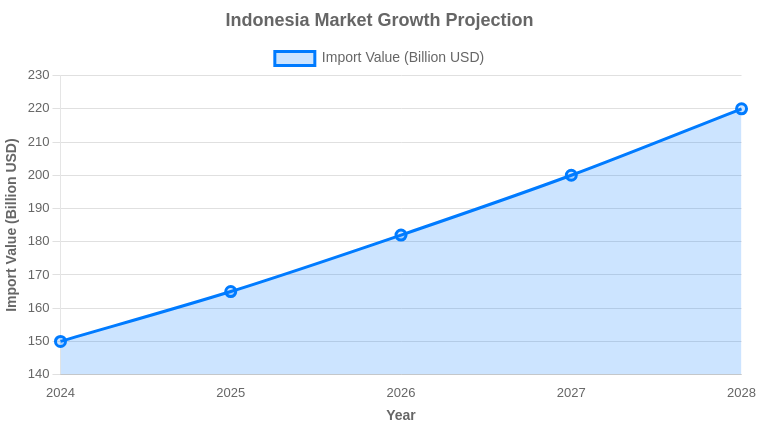

Indonesia isn’t just another market—it’s a booming economic powerhouse that’s catching the eye of savvy exporters worldwide. 🌏 With over 280 million people and a rapidly growing middle class, this archipelago nation represents one of Southeast Asia’s most promising consumer markets. The country’s digital economy is projected to reach $124 billion by 2025, driven by explosive e-commerce growth through platforms like Tokopedia and Shopee. 💻

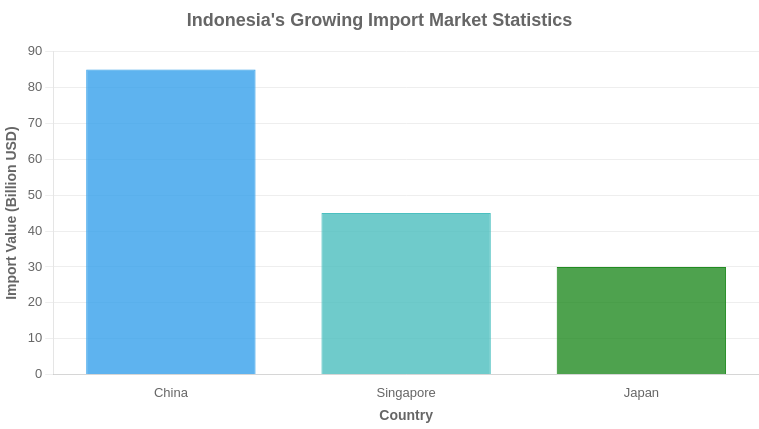

What makes Indonesia particularly attractive right now? The government has been rolling out red carpets for foreign businesses through significant regulatory reforms. Recent BKPM (Investment Coordinating Board) regulations have streamlined import procedures for specific sectors, especially technology, green energy, and healthcare products. 📈 According to recent trade data, Indonesia imported goods worth $221 billion in 2024, with China, Singapore, and Japan leading as top suppliers. This trend is only expected to grow as domestic consumption continues its upward trajectory.

The COVID-19 pandemic actually accelerated Indonesia’s digital transformation, creating new opportunities for exporters of electronics, health products, and home office equipment. 🏠 Recent infrastructure developments, including the expansion of Patimban Port and improvements in the national logistics system, have made it easier than ever to get goods into the country and distributed across its 17,000 islands. The government’s ambitious “Making Indonesia 4.0” initiative is also driving demand for imported machinery, technology, and industrial components. 🏭

For foreign exporters looking to diversify their market reach, Indonesia offers the perfect combination of scale, growth potential, and improving business conditions. But navigating the complexities of shipping to this diverse archipelago requires careful planning and local knowledge. That’s exactly what we’ll cover in this comprehensive guide—so you can tap into this goldmine without the headaches. 💰

Step 1: Know What You Can (and Can’t) Ship 📦

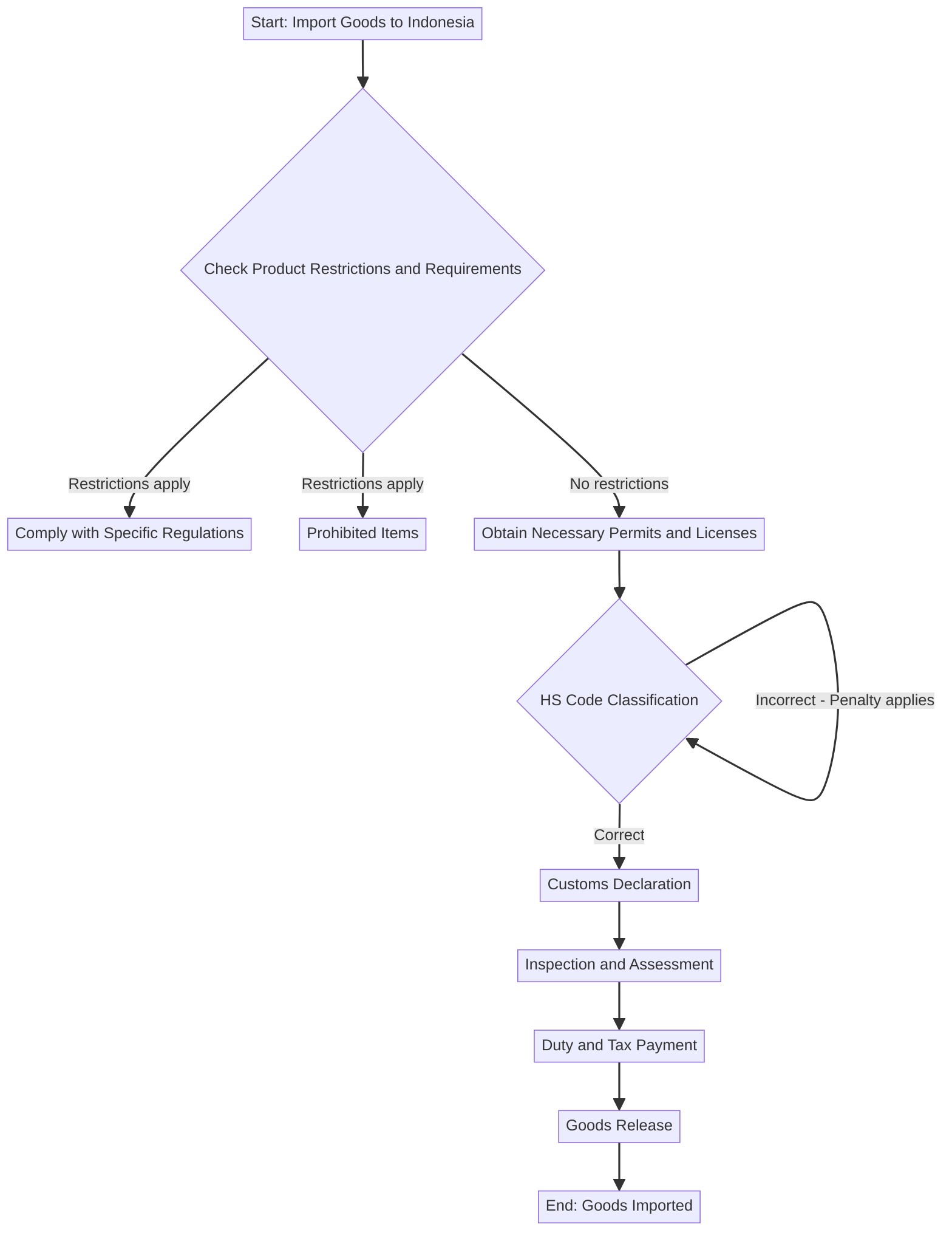

Before you even think about booking freight, you need to understand Indonesia’s import regulations—which items are welcome, which face restrictions, and which are strictly prohibited. 🚫 The Indonesian government maintains both positive and negative import lists that are regularly updated to reflect current economic priorities and protect domestic industries.

According to the latest regulations, including Perka BKPM No. 7 of 2024, certain goods enjoy preferential import treatment, particularly those related to renewable energy, advanced technology, and healthcare equipment. 🌱 These priority items often face lower tariffs and faster clearance procedures. On the flip side, Indonesia maintains strict controls on products that could compete with local manufacturers or pose environmental risks.

The prohibited items list includes narcotics, pornography, certain chemicals, and some telecommunications equipment that doesn’t meet local certification standards. ⚠️ Restricted items require special permits or face quota limitations—these include certain agricultural products, textiles, and secondhand goods. In fact, Indonesia recently implemented a ban on imported secondhand clothing and shoes to protect its domestic textile industry, a move that took effect in early 2025 and caught many exporters by surprise (Key Changes In DGCE Regulation No. 5/2025) .

For consumer goods, electronics, and machinery—the most common imported categories—you’ll need to ensure your products meet Indonesian National Standards (SNI) and obtain the necessary certifications. 📱 This can include everything from safety testing to language requirements for user manuals. The process varies significantly by product category, so it’s essential to research your specific goods before shipping.

Pro tip: Always check the latest regulations before planning your shipment. Indonesia’s import policies can change quickly, and what was allowed last quarter might face new restrictions today. Working with a local partner who stays current on these developments can save you from costly customs hold-ups or even shipment rejections. 💡

Step 2: Master the Paperwork (Without Losing Your Mind) 📑

If there’s one aspect of international shipping that makes exporters break out in a cold sweat, it’s the paperwork. 🤯 Indonesia is no exception—the country requires a comprehensive set of documents for every import shipment, and missing even one can result in significant delays or penalties. But don’t worry! Once you understand what’s needed, the process becomes much more manageable.

The foundation of your import documentation starts with the commercial invoice, which must include detailed descriptions of each product, HS codes, values, and country of origin. 📋 This isn’t just a formality—Indonesian customs officials use this document to determine tariff classifications and calculate duties. Inaccurate or vague descriptions are a red flag that can trigger inspections and delays. Be specific: “men’s cotton shirts” is better than “apparel,” and “smartphone model X with 128GB storage” beats “electronics” every time.

Next up is the packing list, which should match your commercial invoice exactly while providing additional details about weights, dimensions, and packaging materials. 📦 If your shipment includes wood packaging materials, you’ll need an ISPM 15 certificate proving the wood has been properly treated to prevent pest transmission. This requirement is strictly enforced, and shipments without proper certification may be returned or destroyed at your expense.

The bill of lading (for sea freight) or air waybill (for air freight) serves as both a receipt and contract with your carrier, but it’s also crucial for customs clearance. 🚢✈️ Make sure all information matches your other documents exactly—discrepancies in names, addresses, or product descriptions can cause major headaches at customs.

For many products, you’ll also need a Certificate of Origin, which proves where your goods were manufactured. 🌍 If you’re shipping from China or other ASEAN countries, the Form E certificate can provide preferential tariff treatment under the ASEAN-China Free Trade Area agreement. This single document can save you thousands of dollars in duties, so it’s worth the extra effort to obtain.

Additional documentation may include import licenses, product certifications, and specialized permits depending on your product category. For example, food products require registration with BPOM (the National Agency of Drug and Food Control), while electronics need SDPPI certification. The key is to research your specific requirements well in advance and start gathering documents early—some certifications can take weeks or even months to obtain. ⏳

Step 3: Navigate Indonesian Customs Like a Pro 🛃

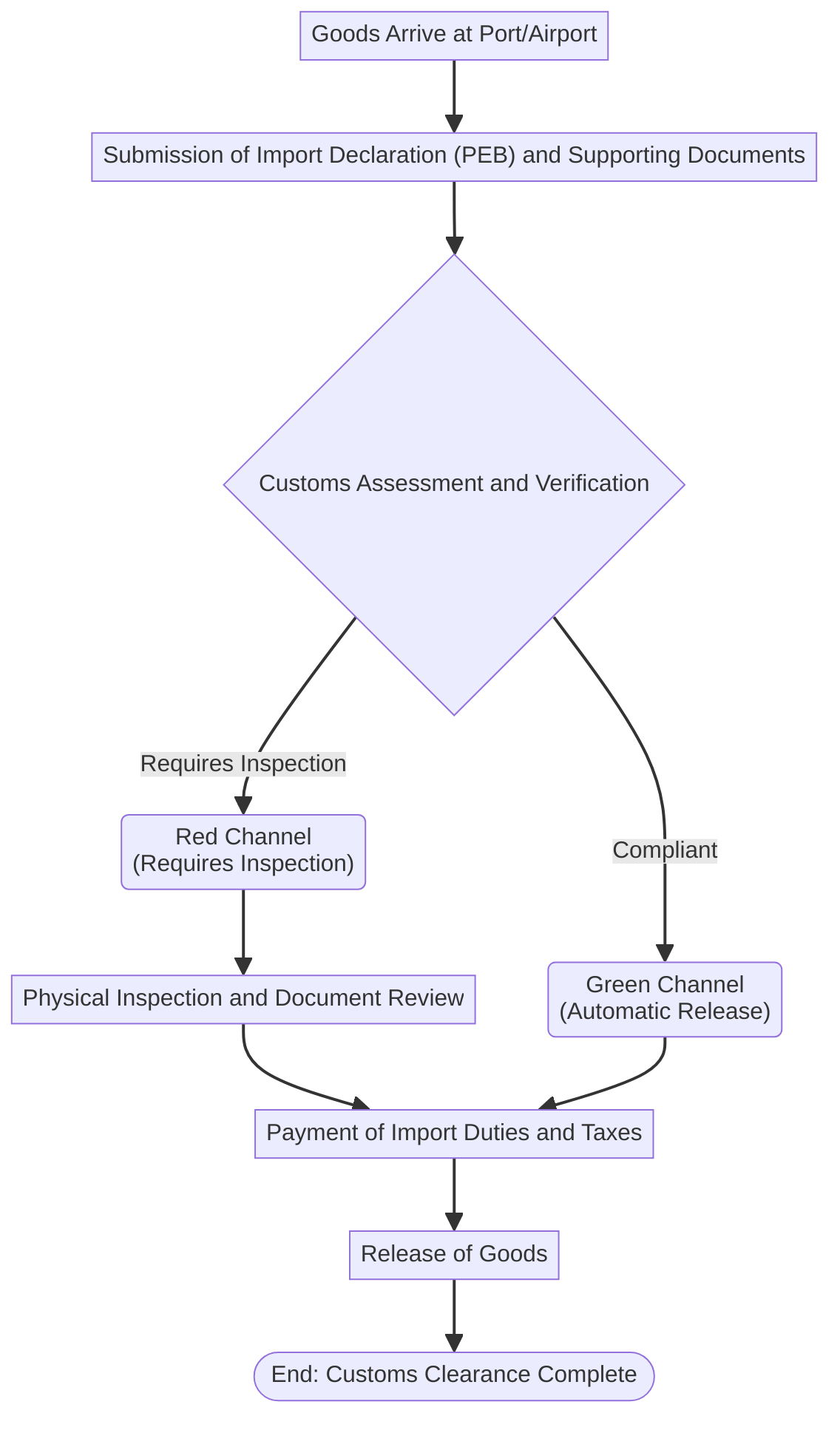

Welcome to what many exporters consider the most challenging part of shipping to Indonesia: customs clearance. 🇮🇩 Indonesian customs (Bea Cukai) has earned a reputation for being complex and sometimes unpredictable, but recent digital transformations are making the process more transparent and efficient—if you know how to work with the system.

The first key to customs success is understanding HS codes (Harmonized System codes) and how they’re applied in Indonesia. 🔢 These numerical classifications determine everything from tariff rates to whether your product requires special permits. Indonesia uses the ASEAN Harmonized Tariff Nomenclature (AHTN), which is based on the international HS system but with some country-specific modifications. Getting your HS codes right from the start is crucial—misclassification can lead to incorrect duty payments, delays, or even penalties.

When your goods arrive in Indonesia, they’ll be subject to several types of taxes and fees. 💰 Import duties typically range from 0% to 40% depending on the product category, with most consumer goods falling in the 10-15% range. On top of that, you’ll pay Value Added Tax (PPN) of 11% (scheduled to increase to 12% in 2025) and potentially Income Tax (PPh 22) of 2.5-10% for importers without tax IDs in Indonesia. These taxes are calculated based on the customs value of your goods, which includes the product cost, insurance, and freight (CIF value).

The game-changer in recent years has been the introduction of the e-NGB (Electronic Goods Declaration) system, which allows for real-time customs clearance processing. 📲 This digital platform has significantly reduced clearance times for compliant shipments—from weeks to just days in many cases. The system automatically calculates duties and taxes, checks for required permits, and flags discrepancies for review. For exporters, this means greater predictability if you have all your documentation in order.

Recent updates to customs procedures, including those outlined in DGCE Regulation No. 5/2025, have further streamlined the process while strengthening enforcement against undervaluation and misdeclaration (Key Changes In DGCE Regulation No. 5/2025) . The red and green channel system remains in place—green channel shipments are cleared automatically with minimal inspection, while red channel shipments undergo physical examination. The key to green channel treatment? Accuracy, completeness, and compliance in your documentation.

For businesses importing regularly, Indonesia offers several customs facilities that can improve efficiency, including temporary importation for exhibition goods and bonded zones for manufacturing inputs. 💼 These special programs require additional approvals but can provide significant benefits for qualifying companies.

Step 4: Choose the Right Shipping Method 🚚

Once you’ve mastered regulations and paperwork, it’s time to get your goods from point A to point B. Indonesia’s unique geography as an archipelago of 17,000 islands means shipping logistics require careful consideration. 🌊 The right shipping method depends on your product type, urgency, budget, and final destination within Indonesia.

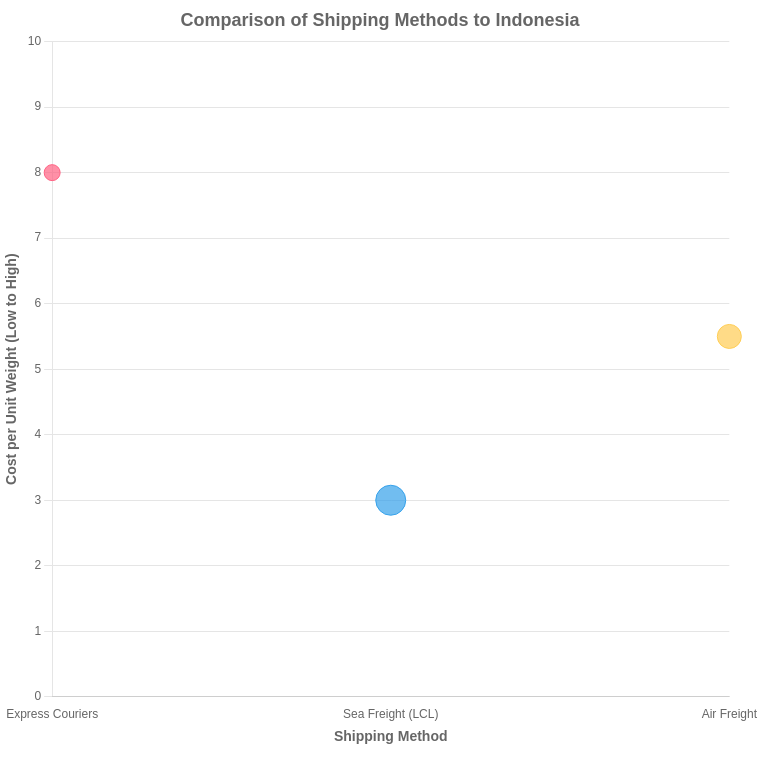

Air freight offers the fastest transit times—typically 3-7 days from major international hubs to Jakarta’s Soekarno-Hatta Airport. ✈️ This makes it ideal for high-value goods, perishables, or time-sensitive shipments. However, speed comes at a premium—air freight costs are generally 4-5 times higher than sea freight. For smaller shipments under 100kg, express couriers like DHL, FedEx, and UPS provide door-to-door service with customs clearance included, making them perfect for samples, documents, or B2C e-commerce orders.

For larger commercial shipments, sea freight remains the most cost-effective option. 🚢 You’ll need to choose between Full Container Load (FCL) and Less than Container Load (LCL) service. FCL makes sense for shipments that fill or nearly fill a standard container (20ft or 40ft), offering better security and lower per-unit costs. LCL allows you to share container space with other shippers, making it economical for smaller volumes—though transit times may be longer due to consolidation and deconsolidation processes.

Major Indonesian ports include Tanjung Priok in Jakarta (the country’s busiest), Tanjung Perak in Surabaya, and the newer Patimban Port, which was developed to ease congestion at Tanjung Priok. 🏗️ Your choice of port should consider the final destination of your goods within Indonesia—shipping to Surabaya makes more sense if your customers are in eastern Java, for example.

Incoterms—international commercial terms—play a crucial role in determining responsibilities and costs between buyer and seller. 📑 The most common terms for Indonesia imports include:

- FOB (Free On Board): Seller delivers goods to the port of loading; buyer handles ocean freight, insurance, and import processes.

- CIF (Cost, Insurance, and Freight): Seller covers costs to the port of destination, but buyer handles import clearance and duties.

- DDP (Delivered Duty Paid): Seller takes responsibility for all costs and risks until goods are delivered to the buyer’s premises—including Indonesian duties and taxes.

For most exporters new to Indonesia, FOB terms offer a good balance of control and cost predictability, allowing you to partner with reliable Indonesian freight forwarders who understand local clearance processes. 🤝

Step 5: Work with the Right Partners in Indonesia 🏢

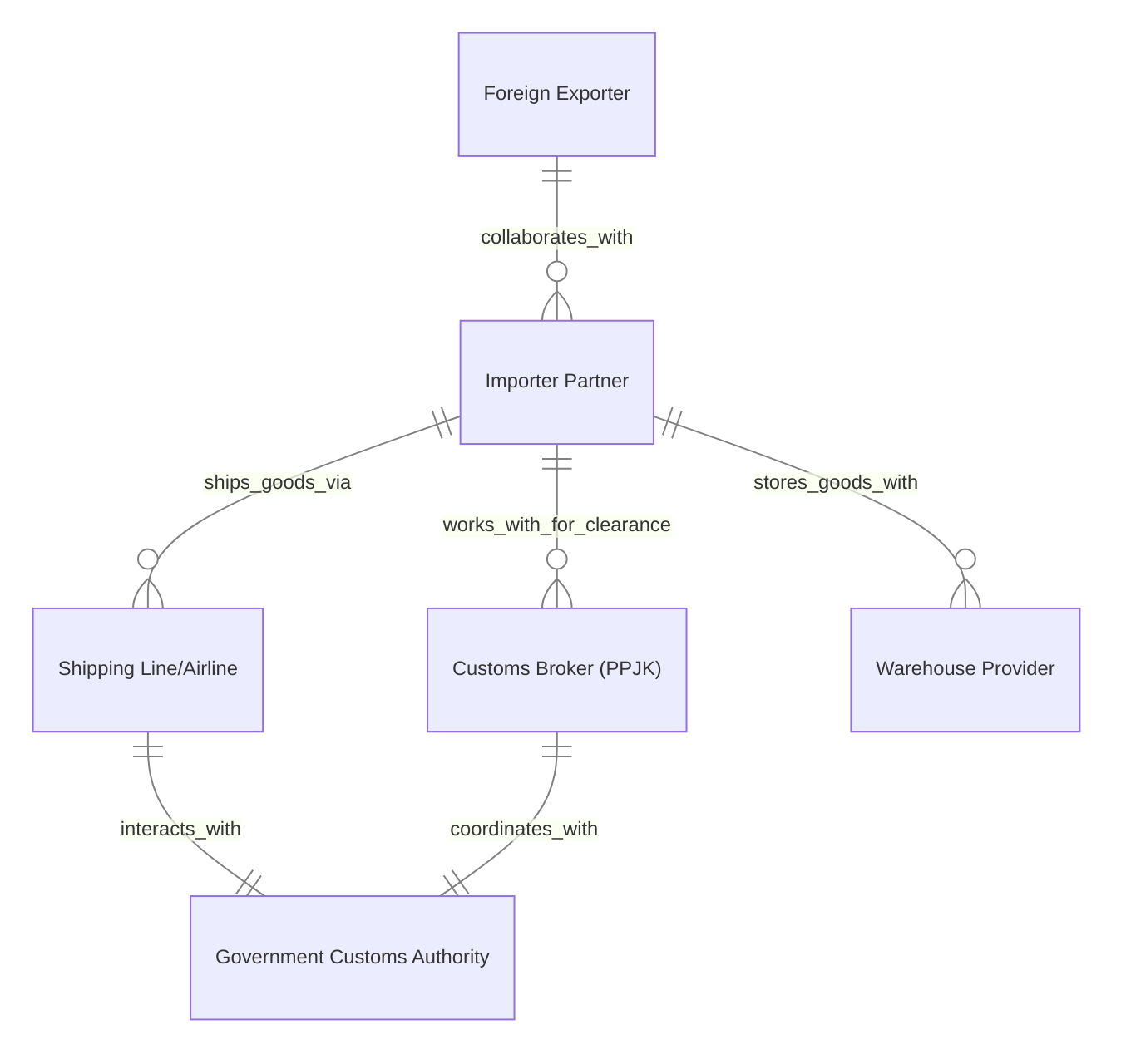

Even with perfect documentation and shipping arrangements, succeeding in Indonesia requires strong local partnerships. 🤝 The country’s business culture, language barriers, and complex regulatory environment make it challenging for foreign exporters to go it alone. Finding the right local partners can mean the difference between smooth operations and constant frustrations.

The first partnership consideration is whether you need a local importer of record. 📋 Indonesia requires many imported products to have a local legal entity responsible for customs clearance and regulatory compliance. This importer of record takes legal responsibility for your shipment, handles duty payments, and ensures compliance with Indonesian regulations. For many foreign exporters, especially those without a local presence, finding a trustworthy importer partner is essential.

Customs brokers (PPJK – Pengusaha Pengurusan Jasa Kepabeanan) are licensed specialists who navigate the customs clearance process on your behalf. 🛃 A good customs broker understands the latest regulations, maintains relationships with customs officials, and can troubleshoot issues as they arise. They’re worth their weight in gold when facing customs inspections or documentation problems. Look for brokers with experience in your specific product category and a track record of successful clearances.

Freight forwarders provide end-to-end logistics services, coordinating transportation, documentation, and customs clearance. 🚚 The best forwarders have their own offices or strong agent networks in Indonesia, allowing them to maintain control over your shipment from origin to final destination. They should offer transparent pricing, regular shipment tracking, and proactive communication about any issues that arise.

For companies planning regular shipments to Indonesia, establishing a relationship with a local logistics provider can provide significant advantages. 📈 These partners can offer warehousing, distribution, and even last-mile delivery services throughout Indonesia’s complex archipelago. They understand local transportation challenges, seasonal variations, and regional differences that can impact your supply chain.

When evaluating potential partners, look for companies with:

- Proper licenses and certifications from Indonesian authorities

- Experience with your specific product category

- Strong communication skills in English (and Indonesian)

- Transparent pricing without hidden fees

- Technology platforms for tracking and documentation

- References from other foreign exporters in your industry

Remember that in Indonesian business culture, relationships matter. 🤝 Taking time to build trust with your local partners through face-to-face meetings (when possible) and regular communication will pay dividends in smoother operations and better problem-solving when challenges arise.

Pro Tips to Avoid Delays & Penalties 💡

Even experienced exporters can stumble when shipping to Indonesia if they’re not aware of common pitfalls. 🚫 Let’s cover some insider tips that can save you time, money, and headaches when navigating Indonesia’s import landscape.

First and foremost: never undervalue your goods on commercial invoices. 📊 Indonesian customs has sophisticated valuation methods and regularly audits import documentation. If they determine you’ve undervalued goods, they can impose penalties equal to the duty difference plus up to 1,000% of the underpaid duties. It’s simply not worth the risk. Declare accurate values and maintain supporting documentation like purchase orders and payment records to prove authenticity if questioned.

Second, pay special attention to pre-shipment inspection requirements for certain product categories. 🔍 While Indonesia has moved away from mandatory pre-shipment inspection for most goods, some items still require verification by appointed surveyors before export. These include used machinery, certain metal products, and items subject to specific technical standards. Check the latest requirements for your products—shipping without proper inspection can result in mandatory re-export at your expense.

Third, understand the importance of the SNI (Indonesian National Standard) certification process. 📋 Many consumer goods, electronics, and building materials must meet SNI standards before they can be legally sold in Indonesia. This certification process can take months and requires product testing by accredited laboratories. Don’t wait until your goods arrive in Indonesia to address SNI requirements—start the certification process well before your first shipment.

Fourth, be prepared for potential inspections even after customs clearance. 🚨 Indonesian authorities including quarantine services (Karantina), food and drug monitoring agency (BPOM), and standardization agency (BSN) may conduct post-clearance audits or physical inspections of imported goods. Maintain all your import documentation for at least five years and ensure your products continue to comply with regulations even after they’ve entered the market.

Fifth, stay updated on regulatory changes. 📰 Indonesia’s import policies can shift quickly in response to economic conditions, trade disputes, or domestic industry protection measures. For example, in early 2025, Indonesia introduced new import restrictions on certain electronics and consumer goods to support domestic manufacturing (INDONESIA INTRODUCES NEW IMPORT POLICY …) . Subscribe to trade alerts, work with informed partners, and consider joining industry associations that monitor regulatory developments.

Finally, build buffer time into your supply chain. ⏳ Even with perfect preparation, delays can happen due to port congestion, weather disruptions, or administrative processing. Plan for an additional 1-2 weeks beyond your estimated transit time, especially for first-time shipments or when introducing new products to the Indonesian market.

Final Thoughts: Indonesia Awaits – Start Smart, Scale Fast 📈

Shipping goods to Indonesia may seem complex, but with the right knowledge and partners, it opens the door to one of the world’s most dynamic consumer markets. 🌏 The country’s digital transformation, growing middle class, and improving business environment create unprecedented opportunities for foreign exporters who take the time to understand and respect local requirements.

The key to success lies in thorough preparation and attention to detail. 📋 From understanding product restrictions to mastering documentation, choosing the right shipping methods, and building strong local partnerships—each step requires careful consideration. But the payoff is substantial: access to a market of 280 million consumers with increasing purchasing power and a growing appetite for imported goods.

Recent regulatory improvements, including the implementation of the e-NGB system and simplified customs procedures, are making it easier than ever to do business in Indonesia (New Guidelines under Indonesia’s MOF Reg. 25/2025 on …) . The government’s commitment to infrastructure development and digital transformation continues to reduce logistics costs and improve efficiency throughout the supply chain.

For businesses willing to invest in understanding the Indonesian market, the rewards extend beyond immediate sales. 🚀 Establishing a presence in Indonesia positions companies for long-term growth in Southeast Asia’s largest economy and provides a platform for expansion to other ASEAN markets. The regional trade agreements and supply chain integration initiatives underway make Indonesia an increasingly strategic hub for international trade.

Remember that success in Indonesia isn’t just about getting goods into the country—it’s about building sustainable, compliant operations that can scale as your business grows. 💼 Take the time to establish proper processes, cultivate strong relationships with local partners, and stay informed about regulatory developments. This foundation will serve you well as you navigate the complexities and opportunities of the Indonesian market.

The journey of a thousand miles begins with a single step—and your first step into the Indonesian market starts with proper shipping and logistics planning. 🛣️ With the guidance provided in this comprehensive overview, you’re well-equipped to begin that journey with confidence and set your business up for success in one of the world’s most exciting emerging markets.

Ready to Unlock Indonesia’s Market? 🎯

You’ve made it through the complete guide to shipping goods to Indonesia—congratulations! 🎉 Now you understand the regulations, documentation requirements, customs procedures, shipping options, and partnership considerations that can make or break your success in this dynamic market.

But knowledge alone isn’t enough. 🚀 To truly thrive in Indonesia, you need experienced partners who can navigate the complexities on your behalf and ensure your goods reach their destination efficiently and compliantly. That’s where M2B comes in.

As Indonesia’s leading logistics provider for international businesses, we specialize in helping foreign exporters like you overcome the challenges of entering this promising market. 🌏 Our team of experts handles everything from customs clearance to last-mile delivery, allowing you to focus on what you do best—growing your business.

Ready to unlock Indonesia’s market without the shipping headaches? Let M2B handle your cross-border logistics—from customs clearance to doorstep delivery. Click below to get a free shipping quote and start selling in Indonesia in under 7 days. 🚀

👉 Get Your Free Shipping Assessment Now

Don’t let logistics challenges keep you from tapping into Indonesia’s $124 billion digital economy. 📈 With M2B as your logistics partner, you gain the local expertise, regulatory knowledge, and operational excellence needed to succeed in this complex but rewarding market.

Take the first step today—your Indonesian customers are waiting! 💼

References

A Step-by-Step Guide on Import to Indonesia. (2025, September). Retrieved from https://www.cekindo.com/blog/import-to-indonesia-guide

Best Guide to Export and Shipping Documents Indonesia 2025. Retrieved from https://www.zenddu.com/guide-to-export-and-shipping-documents/

INDONESIA INTRODUCES NEW IMPORT POLICY … (2025, August). Retrieved from https://ditralaw.com/wp-content/uploads/2025/08/Trade-Law-Legal-Update-MOT-Regulation-16-2025-20250818-Final.pdf

Key Changes In DGCE Regulation No. 5/2025. (2025, April). Retrieved from https://conventuslaw.com/report/indonesia-updates-import-customs-procedures-key-changes-in-dgce-regulation-no-5-2025/

New Guidelines under Indonesia’s MOF Reg. 25/2025 on … (2025, August). Retrieved from https://ssek.com/blog/new-guidelines-under-indonesias-mof-reg-25-2025-on-customs-provisions-for-imports-of-transferred-goods/

Shipping to Indonesia Guide | Key Insights. (2024, August). Retrieved from https://wefreight.com/shipping-guide/shipping-to-indonesia/