🌍 Why Indonesia’s Import Market Is a Goldmine (And Why You Might Be Missing Out) 🚀

Indonesia isn’t just another market—it’s the world’s 16th largest economy with a staggering $150+ billion in annual imports and a consumer base that’s growing faster than almost anywhere else in Southeast Asia! 🇮🇩 But here’s the kicker: while thousands of global businesses are scrambling to get their goods into this dynamic marketplace, most non-resident exporters are hitting brick walls of bureaucracy, confusing regulations, and costly customs delays that turn golden opportunities into expensive nightmares. 😱

The reality? Indonesia’s import landscape has transformed dramatically in 2025, with new digital systems, stricter enforcement, and updated regulations that make the old “just ship and hope” approach completely obsolete. Whether you’re an e-commerce brand, B2B supplier, or small manufacturer looking to expand into Indonesia, understanding these changes isn’t just helpful—it’s absolutely critical for your success. 💡

In this comprehensive guide, we’ll walk you through the 5 essential steps every non-resident must master to successfully export goods to Indonesia without the headaches, fines, or rejected shipments that plague so many first-time exporters. 🎯 We’ve packed this article with the latest 2025 regulatory updates, insider tips from customs brokers, and real-world examples to help you navigate Indonesia’s import maze like a seasoned pro. Ready to unlock one of the world’s most exciting markets? Let’s dive in! 🏊♂️

🤯 Why Most Non-Residents Get Indonesian Imports Dead Wrong (And How to Be the Exception) 📊

Let’s start with some sobering statistics: nearly 40% of first-time shipments to Indonesia from non-resident exporters face significant delays, while 15% are either rejected or sent back entirely—often with hefty fines attached! 😰 These aren’t just numbers; they’re real businesses losing real money because they underestimated Indonesia’s complex import ecosystem.

The core problem? Indonesia operates on a different regulatory wavelength than most Western markets. What works in Europe, North America, or even Singapore can backfire spectacularly in Jakarta’s ports. 🔄 Many exporters assume that because Indonesia has modernized its customs systems (which it has, with digital platforms like INATRADE and INDGEC), the process has become simpler. In reality, while digital submission has streamlined some aspects, it’s also enabled stricter enforcement and faster detection of compliance issues—meaning mistakes that might have slipped through in 2020 now trigger immediate red flags in 2025. 🚩

Recent regulatory changes have raised the stakes even higher. The Ministry of Trade Regulation No. 16/2025 introduced new import approval thresholds and product classification requirements, while MOF Regulation 25/2025 completely overhauled customs valuation rules for transferred goods (Ministry of Trade, 2025) . These aren’t minor tweaks—they’re fundamental shifts that have caught many experienced exporters off guard.

The consequences of getting it wrong extend far beyond delayed shipments. We’ve seen cases where undervaluation attempts led to fines up to $50,000, improper documentation resulted in goods being held for months accruing demurrage fees, and missing certifications caused entire containers to be re-exported at the sender’s expense. 💸 One Singapore-based electronics exporter recently told us how a missing SNI (Indonesian National Standard) certificate cost them $75,000 in combined fines, re-export costs, and lost sales—not to mention the damage to their business reputation with their Indonesian distributor. 😓

But here’s the good news: Indonesia’s import system, while complex, is absolutely navigable when you understand the rules and follow the right process. 🎉 The exporters who succeed in Indonesia aren’t necessarily the biggest or most established—they’re the ones who take the time to understand the local requirements, build the right partnerships, and approach the market with respect for its regulatory framework.

In the next sections, we’ll break down exactly how to do that, starting with the most fundamental step that trips up even experienced exporters: proper product classification and restriction checking. 📋

🔍 Step 1: Check Product Restrictions & Classification (HS Code First!) 🛃

This isn’t just step one—it’s the make-or-break foundation of your entire Indonesia export strategy! 🏗️ Get this wrong, and nothing else matters because your goods won’t even clear the initial screening process. Harmonized System (HS) codes are the international language of trade, but Indonesia adds its own layer of complexity with specific requirements, restrictions, and duties tied to each code. 📊

Here’s what most non-residents get wrong: they either use generic HS codes from their home country or (even worse) skip proper classification entirely, assuming their product category is “obvious.” 🤦♂️ Bad move! Indonesia maintains detailed product-specific regulations that can change based on everything from material composition to intended use. For example, two seemingly identical electronic devices might fall under different HS codes with completely different import requirements based on their technical specifications or certifications. 📱💻

The right approach starts with Indonesia’s official INATRADE system—the digital platform where you can look up precise HS codes and check for any restrictions or special requirements (Indonesia Trade, 2025) . This isn’t optional; it’s your first line of defense against costly mistakes. When accessing INATRADE, you’ll need to enter detailed product information including materials, dimensions, weight, technical specifications, and intended use. The system will then provide you with the correct Indonesian HS code and alert you to any:

- Import bans or restrictions (certain electronics, used goods, and products with religious/cultural sensitivities)

- Special certifications required (SNI for industrial products, BPOM for food/cosmetics, HALAL for certain consumer goods)

- Additional duties or taxes (luxury goods, environmental fees, etc.)

- Import licensing requirements (some products require special import licenses before shipping) 📋

Prohibited vs. Restricted Items: Know the Difference! Many exporters confuse these two categories with disastrous results. Prohibited items (like certain used electronics, narcotics, or politically sensitive materials) cannot be imported under any circumstances and attempting to ship them will result in confiscation and potential legal action. ⚖️ Restricted items, however, can be imported but require special permits, certifications, or approvals. For example:

- Food and beverages: Need BPOM (Food and Drug Supervisory Agency) registration

- Cosmetics: Require BPOM registration and often HALAL certification

- Electronics: Typically need SNI certification and POSTEL registration

- Chemicals: May require environmental impact assessments and special handling permits 🧪

The 2025 updates have added new restrictions in several categories, particularly around environmental standards and digital privacy requirements for connected devices. For instance, new rules under Ministry of Trade Regulation No. 16/2025 now require additional documentation for any product containing rechargeable batteries, while updated environmental standards have changed the requirements for packaging materials (Ministry of Trade, 2025) .

Real-World Example: A U.S.-based fitness equipment manufacturer recently learned this lesson the hard way when their shipment of smart treadmills was held at Tanjung Priok port. They had used the correct HS code for fitness equipment but failed to account for the bluetooth connectivity and data storage features, which triggered additional requirements under Indonesia’s new digital privacy regulations. The result? A six-week delay, $25,000 in storage and demurrage fees, and the need to retrofit products with Indonesian-compliant data handling systems before they could clear customs. 😬

Key Takeaway: Don’t assume anything about your product’s classification. Invest time upfront in proper HS code identification using Indonesia’s official systems, and verify whether your specific product (including all its features and components) faces any restrictions or special requirements. This single step can save you tens of thousands of dollars and months of headaches down the line. 💰 When in doubt, consult with an Indonesian customs broker or trade specialist—this is one area where DIY approaches often backfire spectacularly.

🤝 Step 2: Appoint a Local Importer/PPJK (It’s Not Optional!) 📝

Here’s a reality check that shocks many first-time exporters to Indonesia: non-resident companies cannot directly import goods into Indonesia. 🚫 That’s right—no matter how big your multinational corporation is, you legally need a local entity to handle the import process on your behalf. This local representative is called a PPJK (Pengusaha Pengurusan Jasa Kepabeanan), or Customs Services Entrepreneur, and they’re not just helpful—they’re absolutely mandatory for your success! 🇮🇩

What exactly is a PPJK? Think of them as your Indonesian import guardian angels—licensed customs brokers who specialize in navigating the complex web of Indonesian import regulations, documentation, and clearance processes. 🧭 These aren’t just random freight forwarders; PPJKs are specifically registered and authorized by Indonesian Customs (DJBC) to handle import declarations, duty payments, and customs interactions on behalf of foreign exporters. They maintain bonds with customs authorities, understand the latest regulatory changes, and have relationships with port officials that can mean the difference between smooth clearance and weeks of delays.

Why can’t you just use your regular freight forwarder? Because Indonesian customs law specifically requires import declarations to be made by registered Indonesian entities. Your global logistics provider might have partnerships with PPJKs, but they cannot perform these functions directly. Many exporters learn this the hard way when their shipments arrive at Indonesian ports only to be told “no local importer on file”—resulting in goods being held until proper representation is arranged. 📦

Finding the Right PPJK: Due Diligence is Non-Negotiable! Not all PPJKs are created equal, and choosing the wrong one can be just as costly as not having one at all. Here’s your vetting checklist:

- License Verification: Confirm they hold a valid PPJK license from Indonesian Customs (check the official DJBC website)

- Experience with Your Product Category: A PPJK specializing in textiles might not be ideal for electronics or chemicals

- Digital System Access: Ensure they’re fully integrated with Indonesia’s modern customs platforms (INATRADE, CEISA, etc.)

- References from Non-Resident Clients: Ask specifically about their experience with foreign exporters

- Transparent Fee Structure: Understand their charges upfront—some add hidden fees for “expedited processing” or “special handling” 🔍

Red Flags to Watch For: Be extremely wary of PPJKs who promise “guaranteed clearance” regardless of your documentation, suggest undervaluation to reduce duties, or request unusual payment arrangements. These are classic signs of brokers who cut corners—and while their methods might seem to save money initially, they can lead to severe penalties, blacklisting, or even criminal charges if discovered. 🚨 The Indonesian Customs Directorate has significantly increased its compliance monitoring in 2025, with sophisticated algorithms now flagging unusual patterns or discrepancies across multiple shipments.

The Local Importer Alternative: Some non-residents choose to work with a local importing company rather than a PPJK. This can be a good option if you have an established business relationship with an Indonesian company that’s willing to act as your importer of record. However, this approach comes with its own complexities:

| PPJK | Local Importer |

|---|---|

| Specialized customs expertise | Broader business capabilities |

| Handles multiple clients | Dedicated to your business |

| Lower financial risk exposure | Higher risk (they take ownership of goods) |

| Transactional relationship | Potential for deeper partnership |

| Less control over final distribution | More control over domestic sales |

Critical Contract Points: Whether you choose a PPJK or local importer, your agreement must clearly specify:

- Responsibility boundaries (who handles documentation, duties, inspections?)

- Risk allocation (who bears financial responsibility for delays, damages, or regulatory issues?)

- Payment terms and conditions (especially important for duty payments)

- Dispute resolution mechanisms (Indonesian courts vs. international arbitration)

- Termination clauses (how to transition if you need to change representatives) 📄

2025 Update: New regulations have increased the accountability requirements for PPJKs, making them more liable for the accuracy of import declarations. This means reputable PPJKs are now even more diligent about documentation compliance—which is good for you as long as you’re providing complete, accurate information. However, it also means they’re less likely to “bend the rules” or overlook documentation gaps that might have slipped through in previous years. 📅

Pro Tip: Many successful exporters maintain relationships with two different PPJKs—one primary and one backup. This provides continuity if your main broker has capacity issues or if you need specialized expertise for different product categories. It also gives you leverage in negotiations and ensures you’re never completely dependent on a single service provider.

The Bottom Line: Trying to import to Indonesia without a qualified PPJK or local importer is like trying to climb Mount Everest without a guide—technically possible perhaps, but almost certain to end in disaster. 🏔️ This isn’t a corner you can cut; it’s a fundamental requirement of doing business in Indonesia. Invest the time to find the right partner, establish clear expectations, and maintain open communication throughout the import process. Your future self (and your balance sheet) will thank you! 🙏

📑 Step 3: Prepare the 6 Core Documents (No Shortcuts Allowed!) ✅

Welcome to what most exporters consider the paperwork nightmare phase of Indonesian imports—but with the right approach, it doesn’t have to be painful! 📋 Indonesia’s document requirements are famously thorough, and for good reason: they form the backbone of customs valuation, duty assessment, and regulatory compliance. Skip or fudge even one of these documents, and you’re looking at delays, fines, or outright rejection of your shipment. 🚫

The Non-Negotiable Document Checklist: While specific requirements vary by product category, virtually all commercial shipments to Indonesia require these six core documents:

- Commercial Invoice: Not just any invoice—this must include detailed product descriptions, HS codes, unit values, total value, currency, payment terms, and complete contact information for both exporter and importer. Pro tip: Indonesia scrutinizes invoices for undervaluation, so ensure your pricing reflects true market value. 💵

- Packing List: This should match your invoice exactly and include detailed information about packaging: number of packages, dimensions, weight (net and gross), package markings, and contents of each package. Discrepancies between your packing list and physical cargo are a major red flag for customs officials. 📦

- Bill of Lading (B/L) or Air Waybill: Your transport document that serves as both receipt and title to the goods. For sea freight, the original B/L is typically required unless you’re using telex release. Ensure all details match your other documents perfectly. 🚢✈️

- Certificate of Origin: This document proves where your goods were manufactured and can significantly impact duty rates (especially if you’re claiming preferential treatment under ASEAN trade agreements). Must be issued by an authorized chamber of commerce or similar body in your country. 🌍

- Import License/Approval (PI): Many product categories require a special Import License (PI) or approval before shipping. This must be obtained by your PPJK or local importer before your goods depart—they cannot be applied for retroactively! 📜

- Insurance Certificate: Proof of cargo insurance covering the shipment’s value. Indonesia requires this for all commercial imports, and it must clearly show the insured amount, coverage terms, and beneficiary details. 🛡️

2025 Documentation Changes That Could Trip You Up: The implementation of MOF Regulation 25/2025 has introduced new requirements for transferred goods valuation and digital submission protocols (Ministry of Finance, 2025) . Key changes include:

- Enhanced valuation requirements for related-party transactions, requiring additional documentation to prove arm’s-length pricing

- Mandatory digital submission of all documents through Indonesia’s CEISA 4.0 system (paper submissions are no longer accepted at most major ports)

- New certification requirements for certain product categories, particularly electronics and consumer goods

- Stricter conformity with HS code descriptions—generic descriptions like “electronics” or “machinery parts” will trigger automatic reviews

Most Costly Documentation Mistakes (And How to Avoid Them): Based on 2025 data from Indonesian Customs, these documentation errors cause the most delays and penalties:

| Mistake | Average Delay | Typical Fine | How to Prevent |

|---|---|---|---|

| Undervaluation | 14-21 days | Up to $50,000 | Use independent valuation reports for high-value goods |

| HS Code Mismatches | 7-14 days | $5,000-$20,000 | Double-check with Indonesian customs broker |

| Missing PI Approvals | 10-30 days | $3,000-$15,000 | Secure before shipping |

| Inconsistent Data | 5-10 days | $1,000-$5,000 | Cross-check all documents before submission |

| Outdated Forms | 3-7 days | $500-$2,000 | Use current 2025 templates |

Digital Submission Best Practices: Indonesia’s modernization efforts mean most documentation is now submitted electronically through systems like CEISA 4.0 and INATRADE. While this has streamlined the process in many ways, it also means:

- Data must be perfectly consistent across all systems—discrepancies between electronic and physical documents trigger automatic reviews

- Digital signatures and authentication are required for most submissions

- Real-time status tracking is available, but you need to know where and how to check it

- Automated compliance checks will flag any irregularities before human reviewers even see your documents

Pro Documentation Strategy: Create a master document checklist specific to your product category and update it quarterly to reflect regulatory changes. Many successful exporters use a “document verification workflow” where:

- Your internal team prepares initial documents using current Indonesian templates

- Your Indonesian PPJK reviews them for compliance before goods ship

- A third-party trade compliance specialist does a final check (especially valuable for high-value or regulated shipments)

- All parties maintain digital copies in a shared cloud system with version control ☁️

Special Cases and Additional Documents: Depending on your products, you may need additional documentation:

- SNI Certification: For industrial products, electronics, and building materials

- BPOM Registration: For food, beverages, cosmetics, and health products

- HALAL Certificate: For food, cosmetics, and certain consumer goods

- Environmental Permits: For chemicals, hazardous materials, and certain electronics

- Telecom Certifications: For wireless devices and connected electronics 📶

The Bottom Line on Documentation: Indonesian customs officials are trained to spot inconsistencies and irregularities, and their systems are increasingly sophisticated at identifying potential compliance issues. Complete, accurate, and consistent documentation isn’t just a regulatory requirement—it’s your best insurance policy against costly delays and penalties. Invest in proper document preparation, work closely with your Indonesian PPJK, and never assume that “close enough” will suffice. In Indonesian imports, precision isn’t just appreciated—it’s absolutely essential! 🎯

🚢 Step 4: Navigate Customs Clearance Like a Pro 🛃

Congratulations! Your goods have arrived in Indonesia and you’ve got all your documents in order. Now comes the moment of truth: customs clearance—the process that can make or break your entire import operation. ⏱️ For many non-resident exporters, this is where anxiety peaks, as goods sit in port accumulating demurrage fees while navigating Indonesia’s customs procedures. But with the right knowledge and preparation, you can turn this from a nerve-wracking ordeal into a predictable, manageable process. 😌

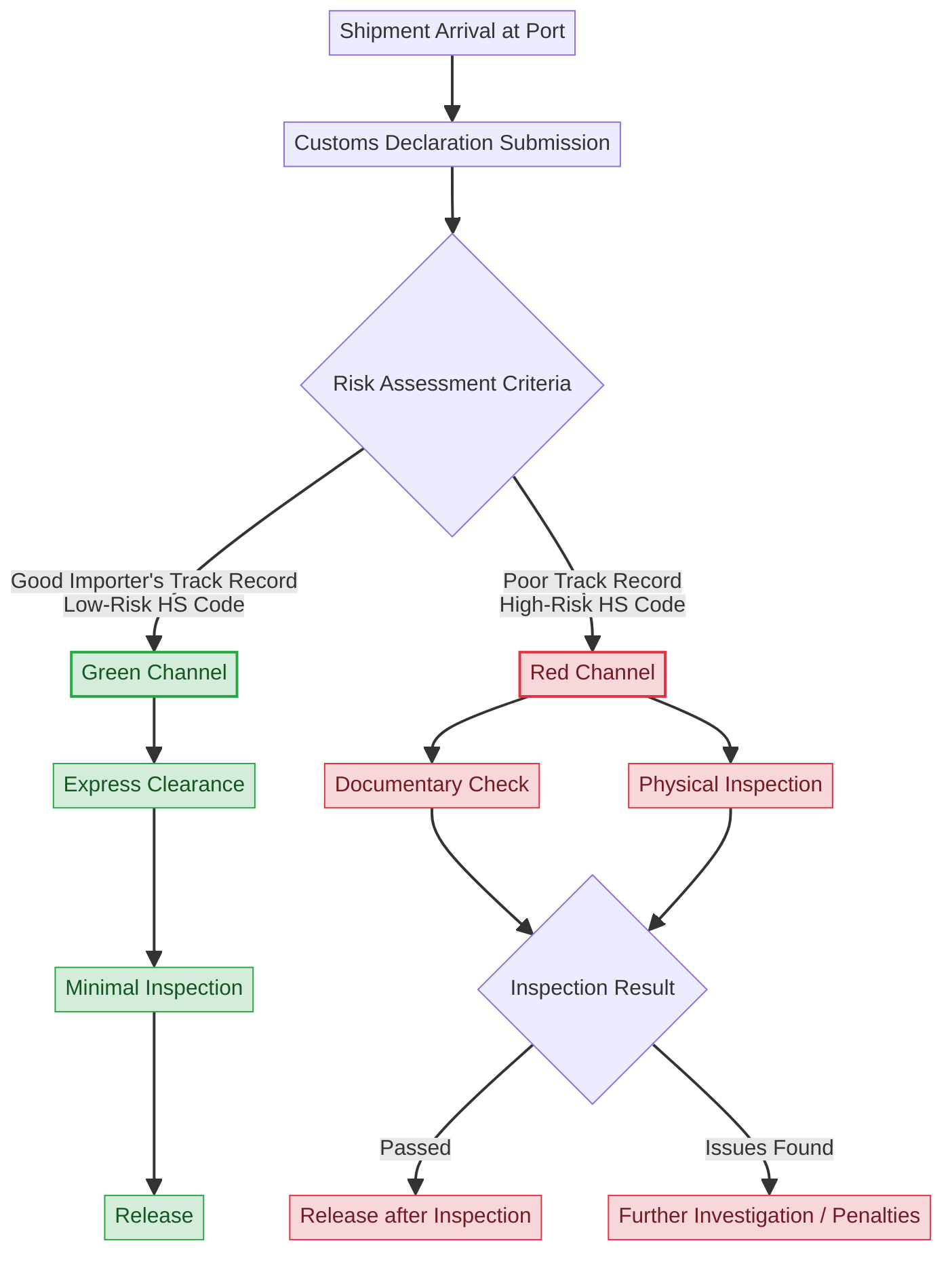

Understanding Indonesia’s Clearance System: Indonesia operates on a risk-based clearance system that routes shipments through different channels based on risk assessment:

- Green Channel (Approx. 30% of shipments): Minimal inspection,快速 clearance (typically 1-2 days). These are generally low-risk shipments from established importers with clean compliance histories.

- Yellow Channel (Approx. 50% of shipments): Document verification with possible physical inspection (typically 3-5 days). Most commercial shipments fall into this category.

- Red Channel (Approx. 20% of shipments): Full document examination and mandatory physical inspection (typically 5-14 days or longer). High-value shipments, first-time importers, or shipments flagged by risk assessment. 🚨

Key Factors That Determine Your Channel: Indonesia’s automated risk assessment system considers multiple variables when assigning your shipment to a clearance channel:

- Importer’s compliance history (established importers with clean records get preferential treatment)

- Product category and risk profile (regulated goods like electronics, chemicals, and food typically get more scrutiny)

- Country of origin (shipments from certain countries face higher scrutiny)

- Value and volume (high-value or large shipments receive more attention)

- Documentation completeness and consistency (discrepancies trigger automatic red flags)

- Previous violations (any compliance issues in your import history)

2025 Clearance Trends You Need to Know: Indonesian Customs has invested heavily in digital transformation with systems like CEISA 4.0 and INATRADE, leading to several important changes:

- Average clearance times have decreased to 3.2 days for standard commercial shipments (down from 5.7 days in 2023) (World Bank, 2025)

- Digital document submission is now mandatory at all major ports, reducing paperwork but requiring perfect data consistency

- Pre-arrival processing allows for certain clearance steps to begin before goods arrive, potentially reducing delays

- Automated risk assessment has become more sophisticated, using AI and machine learning to flag potential issues

- Payment systems have been integrated with most major banks, allowing for faster duty processing 💳

The ISF Filing Requirement: One of the most critical (and often overlooked) steps in Indonesian customs clearance is the Import Declaration (PIB) submission, which must be filed electronically through the CEISA system before goods arrive. This includes:

- Advanced manifest data submitted by the carrier

- Import declaration details filed by your PPJK

- Duty and tax calculations based on product classification and value

- Supporting document uploads (commercial invoice, packing list, etc.)

Best Practice: File your PIB as early as possible—ideally before your goods even depart from the origin country. This allows Indonesian customs to begin processing your declaration in advance, potentially reducing clearance time by days. Many successful exporters work with their PPJK to establish a “pre-filing workflow” where documentation is prepared and submitted immediately upon shipping. 📅

Physical Inspections: What to Expect and How to Prepare: If your shipment is routed to the yellow or red channel, it will undergo physical inspection. Here’s what happens:

- Customs officials will supervise the unloading and opening of containers

- Goods will be examined for quantity, quality, and compliance with declared information

- Samples may be taken for laboratory testing (especially for regulated products)

- Photos and videos will be recorded as evidence of the inspection process 📸

Pro Tip: If you know your products will likely face inspection (high-value items, regulated goods, first-time shipments), consider using preshipment inspection services that can identify and address potential issues before your goods arrive in Indonesia. While this adds cost, it can prevent much more expensive delays and rejections later. 🔍

Duty and Tax Payment: The Financial Hurdle: Customs clearance can’t be completed until all duties and taxes are paid. Indonesia’s import tax structure includes:

- Import Duty (typically 0-15%, depending on product)

- Value Added Tax (VAT) (currently 11%, scheduled to increase to 12% in 2025)

- Income Tax (Article 22) (typically 2.5-7.5% for importers)

- Luxury Goods Sales Tax (for specific high-end products) 💰

Payment Process: Your PPJK will calculate the exact amounts and facilitate payment, but funds must be available in Indonesian rupiah through Indonesian banks. Many non-resident exporters are surprised by the short payment window—typically 24-48 hours after duty assessment—so working with your PPJK to ensure payment readiness is crucial.

Common Clearance Delays and How to Avoid Them: Based on 2025 data from Indonesian logistics providers, these are the most frequent causes of clearance delays:

- Documentation Issues (35% of delays): Incomplete, inconsistent, or incorrect documents

- HS Code Disputes (25% of delays): Disagreements over proper product classification

- Valuation Challenges (20% of delays): Customs disagreeing with declared values

- Missing Certifications (15% of delays): Required product certificates not provided

- Payment Delays (5% of delays): Issues with duty and tax payment processing

Emergency Contingency Planning: What happens when things go wrong? Smart exporters have clear contingency plans for common clearance issues:

- Designated emergency contact at your PPJK available 24/7

- Budget buffer for unexpected duties, fees, or storage costs

- Alternative routing options if primary port experiences delays

- Legal support network for serious compliance disputes

- Customer communication plan to manage expectations if delivery is delayed 📞

The Bottom Line on Customs Clearance: Indonesian customs clearance doesn’t have to be the nightmare scenario many exporters fear. With proper preparation, accurate documentation, early filing, and a qualified PPJK partner, the process can be smooth and predictable. The key is understanding the system, respecting the requirements, and investing in proper compliance from the start. Remember: in Indonesian imports, prevention is always cheaper than cure—and nowhere is this more true than in customs clearance! 🎯

💳 Step 5: Choose the Right Logistics & Payment Flow (Protect Your Profits!) 🛡️

You’ve navigated product restrictions, found a PPJK, prepared perfect documentation, and cleared customs—congratulations! 🎉 But you’re not quite done yet. Your final critical decision involves selecting the right logistics approach and payment structure, choices that will directly impact your profitability, risk exposure, and long-term success in the Indonesian market. Get this wrong, and even perfectly executed previous steps might not save your bottom line. 💸

FOB vs. CIF: The Incoterm Decision That Matters Most: When exporting to Indonesia, your choice of Incoterms (International Commercial Terms) isn’t just technical jargon—it’s a fundamental decision about risk, responsibility, and control. Let’s break down the two most common options:

FOB (Free On Board): With FOB terms, you (the exporter) are responsible for getting the goods to the port of loading and covering all costs until the goods pass the ship’s rail. At that point, risk transfers to the Indonesian importer. Benefits for exporters:

- Clear risk cutoff once goods are loaded

- Simpler pricing structure (you don’t need to calculate international shipping)

- Reduced liability for any shipping delays or issues

- Easier to manage from your home country 🚢

CIF (Cost, Insurance, Freight): With CIF, you’re responsible for arranging and paying for the main carriage to Indonesia and obtaining marine insurance. Potential benefits:

- More control over shipping arrangements and carriers

- Additional revenue opportunity from shipping markups

- Single point of contact for the Indonesian importer

- Potential volume discounts on shipping costs 📊

2015 Indonesia-Specific Consideration: While CIF gives you more control, it also extends your risk exposure significantly. Indonesian ports can experience congestion, bureaucratic delays, and other issues that might not be your fault but become your problem under CIF terms. Most experienced exporters to Indonesia prefer FOB terms for this very reason—it creates a clean handoff and limits their risk exposure. However, if you have established logistics partnerships in Indonesia and understand the risks, CIF can work well for certain products and business models.

Local Warehousing: The Game-Changer for Regular Exporters: If you’re planning to export to Indonesia regularly, local warehousing deserves serious consideration. Instead of shipping directly to each customer or distributor, you can maintain inventory in Indonesia, enabling:

- Faster delivery times to Indonesian customers (critical for e-commerce and time-sensitive products)

- Consolidated shipments that reduce per-unit shipping costs

- Local quality control and final assembly/packaging

- Smoother customs processing through regular, predictable imports

- Better cash flow management through just-in-time inventory 🏭

Major Indonesian Warehousing Hubs:

- Jakarta (Tanjung Priok Port area): Largest port facilities, best for national distribution

- Surabaya (Tanjung Perak Port): Eastern Indonesia gateway, lower costs than Jakarta

- Batam (Free Trade Zone): Special tax advantages, ideal for re-export to ASEAN

- Semarang: Central Java access, growing infrastructure

2025 Warehousing Trends: Indonesia has seen significant growth in modern logistics facilities with temperature control, security systems, and integrated customs clearance capabilities. Third-party logistics providers (3PLs) now offer comprehensive solutions including warehousing, last-mile delivery, and even returns processing—making it easier than ever for non-residents to establish local inventory without setting up their own Indonesian entity. 📦

Payment Security: Protecting Your Cash Flow: Let’s be honest—getting paid is arguably the most critical part of any export transaction. Indonesia presents some unique challenges in this area, but several strategies can help protect your interests:

Letter of Credit (LC): Still the gold standard for secure international trade, an LC is a bank guarantee that payment will be made to you as long as you meet the specified terms and conditions. Benefits:

- Bank-backed security regardless of buyer’s financial situation

- Clear, objective payment terms defined upfront

- Established international framework with standardized processes

- Financing options available against confirmed LCs 🏦

Downsides: LCs can be expensive (fees typically 1-3% of transaction value), require meticulous documentation compliance, and may delay payment until all conditions are verified. They’re generally recommended for first-time transactions or high-value shipments where risk is a major concern.

Escrow Services: A modern alternative gaining popularity in Indonesia trade, escrow services hold funds from the Indonesian buyer and release them to you once certain conditions are met (like goods clearing customs or being delivered). Advantages:

- Lower costs than traditional letters of credit

- Faster processing with digital platforms

- Flexible terms that can be customized per transaction

- Increased trust for both parties in the transaction 🔒

Advance Payment: The simplest approach—requiring some or all payment before shipping. While this offers maximum security for you as the exporter, many Indonesian buyers resist this approach, especially for first-time transactions. A common compromise is partial advance payment (30-50%) with the balance due upon delivery or after customs clearance.

Payment Method Comparison for Indonesian Exports:

| Method | Risk Level | Cost | Speed | Best For |

|---|---|---|---|---|

| Letter of Credit | Very Low | High (1-3%) | Slow (7-14 days) | High-value, first-time transactions |

| Escrow | Low | Medium (0.5-1.5%) | Medium (3-7 days) | Medium-value, online transactions |

| Advance Payment | Minimal | Low | Fast (1-3 days) | Established relationships, small orders |

| Open Account | High | Low | Fast (1-3 days) | Long-term partnerships, regular shipments |

Currency Considerations: Indonesia maintains some foreign exchange regulations that can impact payment processing. While most commercial transactions can be conducted in USD or other major currencies, certain documentation and reporting requirements apply. Work with your bank and Indonesian partners to ensure compliance and consider the currency risk of holding Indonesian rupiah balances if you plan regular exports.

Building Long-Term Logistics Partnerships: For exporters planning to establish a significant presence in the Indonesian market, developing strategic logistics partnerships can provide competitive advantages:

- Integrated service providers who handle documentation, customs, warehousing, and delivery

- Technology platforms offering real-time tracking, inventory management, and order processing

- Local distribution networks with last-mile capabilities across Indonesia’s diverse geography

- Reverse logistics solutions for returns and repairs (critical for electronics and consumer goods) 🔄

The Bottom Line on Logistics and Payments: Your choices in these final areas can significantly impact your profitability and risk exposure in the Indonesian market. Protect your interests through appropriate Incoterms, secure payment methods, and strategic logistics planning. Remember that Indonesia is a market where relationships matter—building strong partnerships with reliable logistics providers and establishing trust with Indonesian buyers will pay dividends in smoother operations and better terms over time.

With these five key steps mastered, you’re well-equipped to successfully export to Indonesia and tap into one of the world’s most exciting growth markets! 🌏

⚠️ Top 3 Mistakes That Get Shipments Sent Back (And How to Dodge Them!) 🚫

Even experienced exporters can fall victim to these costly pitfalls when shipping to Indonesia. 😱 Based on 2025 customs data, these three mistakes account for over 60% of all rejected shipments—and the financial consequences can be devastating. Let’s break down each disaster scenario and, more importantly, how you can avoid becoming the next cautionary tale! 📚

🚨 Mistake #1: Undervaluation (The $50,000 Gamble That Never Pays Off) 💰

The Temptation: It seems so logical—if you declare a lower value for your goods, you’ll pay less in duties and taxes, making your products more competitive in the Indonesian market. Many exporters think they’re being clever by “adjusting” their commercial invoices to reflect lower prices, especially for high-margin products. 🤫

The Reality: Indonesian customs officials are valuation experts with sophisticated systems for detecting undervaluation. They maintain extensive databases of market prices for thousands of product categories and can quickly identify when declared values don’t align with market realities. In 2025 alone, Indonesian customs assessed over $12 million in penalties for undervaluation, with individual fines reaching up to $50,000 per violation (Indonesian Customs, 2025) . 😬

How They Catch You:

- Market price databases that track average values for similar products

- Previous shipment data from your company and competitors

- Supplier verification checks that can reveal true manufacturing costs

- Price discovery requests that require you to prove your declared values

- Coordinated enforcement between customs and tax authorities 🔍

The Consequences: When undervaluation is detected, you face:

- Substantial fines (often 2-5 times the evaded duty amount)

- Blacklisting of your company and products

- Criminal charges in severe cases (intentional fraud)

- Loss of goods if you can’t pay the penalties

- Reputational damage that affects future trade opportunities ⚖️

How to Avoid This Mistake:

- Declare accurate, arm’s-length values that reflect true market prices

- Maintain detailed documentation supporting your valuation (cost breakdowns, market studies)

- Consider using independent valuation reports for high-value shipments

- Work with your Indonesian PPJK to understand acceptable valuation ranges

- Negotiate better terms with Indonesian buyers rather than manipulating values 💡

Real-World Example: A European furniture manufacturer learned this lesson the hard way when they consistently undervalued their luxury dining sets by 40-50%. Over 18 months, this “strategy” saved them approximately $80,000 in duties—until Indonesian customs conducted a targeted audit. The result: a $220,000 fine (covering the evaded duties plus penalties), blacklisting that prevented them from importing for two years, and the loss of their Indonesian distributor who found alternative suppliers during the blackout period. The total cost exceeded $500,000 when including lost business. 😳

🚨 Mistake #2: Missing SNI or BPOM Certifications (The Paperwork Trap) 📑

The Temptation: Product certification seems like unnecessary bureaucracy, especially for products that meet international standards in your home market. Many exporters assume that if their products are approved in the EU, US, or other developed markets, they’ll automatically qualify for Indonesia. Others simply don’t understand which products require which certifications. 🤷♂️

The Reality: Indonesia maintains strict mandatory certification requirements for many product categories, and international certifications generally don’t substitute for Indonesian ones. The two most common certification traps are SNI (Standar Nasional Indonesia) for industrial products and building materials, and BPOM (Badan Pengawas Obat dan Makanan) for food, beverages, cosmetics, and health products. 🧪

Common Products Requiring SNI Certification:

- Electrical and electronic products

- Building materials (cement, steel, glass)

- Automotive components

- Household appliances

- Toys and children’s products 🧸

Common Products Requiring BPOM Registration:

- Food and beverages

- Cosmetics and personal care products

- Supplements and traditional medicines

- Household chemicals

- Food contact materials 🍽️

The Consequences: Shipping products that require certification without the proper paperwork typically results in:

- Immediate rejection at the port of entry

- Forced re-export at your expense

- Destruction of goods in some cases (especially for prohibited items)

- Blacklisting of your company and product categories

- Lost sales and damaged relationships with Indonesian partners 📦

How to Avoid This Mistake:

- Research certification requirements before shipping ANY product to Indonesia

- Start the certification process early—it can take 3-12 months depending on the product

- Work with specialized certification consultants who understand Indonesian requirements

- Consider alternative products that don’t require certification for initial market entry

- Budget for certification costs (typically $3,000-$15,000 per product) 📋

Real-World Example: A U.S. organic skincare company spent six months developing an Indonesian distribution strategy and shipped $120,000 worth of products to Jakarta, only to have everything rejected at customs due to missing BPOM registration. The company had assumed their USDA Organic certification would be sufficient. They faced three options: destroy the goods, re-export at a cost of $35,000, or apply for emergency BPOM registration (which would take 4-6 months and cost $25,000). They chose re-export, but by the time they returned with properly certified products a year later, their Indonesian distributor had moved on to a competitor who had already established market presence. Total loss: approximately $250,000 including opportunity costs. 😔

🚨 Mistake #3: Incomplete AEO/ISPM 15 Compliance (The Hidden Regulatory Landmine) 💣

The Temptation: These requirements seem technical and optional to many exporters. AEO (Authorized Economic Operator) status is often seen as just another bureaucratic designation, while ISPM 15 (wood packaging regulations) appears to be a minor technicality about shipping materials. Many exporters simply don’t prioritize these compliance areas. 🌲

The Reality: Indonesia has significantly increased enforcement of these requirements in 2025, with severe consequences for non-compliance. AEO status, while voluntary, provides expedited clearance and reduced inspections—making it practically essential for regular exporters. ISPM 15 compliance, meanwhile, is mandatory for all wood packaging materials used in international shipments to Indonesia, including pallets, crates, and dunnage. 📦

AEO Benefits in Indonesia:

- Expedited customs clearance (green channel priority)

- Reduced inspection rates (up to 70% fewer physical inspections)

- Simplified documentation requirements

- Dedicated customer service from customs authorities

- Enhanced credibility with Indonesian business partners 🏆

ISPM 15 Requirements:

- All wood packaging must be heat-treated or fumigated according to international standards

- Treatment must be certified and marked with the official ISPM 15 stamp

- Packaging must be clean and free from pests and bark

- Documentation must verify treatment compliance 🪵

The Consequences: Non-compliance with these requirements can lead to:

- Immediate rejection of shipments with non-compliant wood packaging

- Mandatory treatment or destruction of packaging materials at your expense

- Extended delays while compliance issues are resolved

- Increased inspection rates for future shipments

- Loss of AEO benefits if you’ve achieved this status 🔍

How to Avoid This Mistake:

- Apply for AEO status if you plan regular exports to Indonesia (work with your PPJK on this)

- Verify all wood packaging meets ISPM 15 standards before shipping

- Use alternative materials (plastic, metal, composite) for packaging when possible

- Document your compliance with proper certificates and markings

- Train your logistics partners on Indonesian packaging requirements 📚

Real-World Example: A Malaysian electronics manufacturer lost their AEO status after three years of stellar compliance history due to a single shipment with improperly marked wood pallets. The ISPM 15 stamps were present but didn’t include the required country code and treatment facility identifier. While this seems like a minor technicality, Indonesian customs treated it as a serious compliance violation. The result: loss of AEO status, which increased their average clearance time from 2 days to 8 days and raised their inspection rate from 15% to 85%. Over the next year, they estimated the additional costs at approximately $180,000 in storage fees, delayed deliveries, and lost customer confidence. 📉

The Bottom Line: These three mistakes—undervaluation, missing certifications, and compliance failures—represent the most common and costly traps for exporters to Indonesia. The pattern is clear: shortcuts always cost more in the long run. By investing in proper valuation, securing necessary certifications, and maintaining rigorous compliance with technical requirements, you protect your business from devastating financial losses and position yourself for sustainable success in the Indonesian market.

Remember: in Indonesian imports, attention to detail isn’t optional—it’s the difference between profit and disaster! 🎯

🛠️ Smart Tools & Resources for Non-Residents (Your Indonesia Import Toolkit) 🧰

Navigating Indonesia’s import landscape doesn’t have to be a solo journey! 🚀 The Indonesian government and private sector have developed numerous digital tools and resources designed specifically to help non-resident exporters succeed. In this section, we’ll explore the essential platforms, services, and information sources that can transform your Indonesia import experience from challenging to manageable. Let’s build your personal Indonesia import toolkit! 🧰

🌐 Government Digital Platforms: Your Official Information Sources 📡

INATRADE (Indonesia National Trade System): This is your primary gateway to Indonesia’s trade information and services. Operated by the Ministry of Trade, INATRADE provides:

- HS Code lookup tools with Indonesian-specific classifications

- Product restriction information updated in real-time

- Import license application portals for various product categories

- Trade statistics and market data to inform your export strategy

- Direct links to other relevant government systems (Indonesia Trade, 2025)

Pro Tip: Create an INATRADE account even before your first shipment. The platform offers email alerts for regulatory changes that might affect your products, helping you stay ahead of compliance requirements. 📧

INDGEC (Indonesia Gateway for Electronic Commerce): If you’re exporting consumer goods, especially through e-commerce channels, INDGEC is essential. This platform integrates multiple government services for digital trade:

- Simplified customs declarations for low-value shipments

- Integrated tax payment systems for small and medium-sized exporters

- Digital certificate management for product registrations

- E-commerce specific guidelines and compliance checklists

- Direct integration with major Indonesian marketplaces (Tokopedia, Shopee, etc.) 🛒

CEISA 4.0 (Customs-Excise Information System and Automation): This is Indonesia’s next-generation customs platform that has transformed clearance procedures. For non-resident exporters, CEISA offers:

- Real-time shipment tracking through customs stages

- Digital document submission with immediate validation feedback

- Automated duty calculation tools for planning purposes

- Compliance risk assessment indicators

- Historical clearance data for your products and importer 📊

BKPM (Investment Coordinating Board) Services: While primarily focused on investment, BKPM offers valuable resources for exporters considering deeper market engagement:

- Investment climate information relevant to import-dependent businesses

- Industrial park directories with integrated customs facilities

- Regulatory update services for foreign businesses

- One-stop service portals for complex licensing requirements

- Direct consultation options with trade specialists 🏢

🤖 AI-Powered Assistants and Chatbots: Your 24/7 Compliance Helpers 📱

Customs Chatbots: Indonesian Customs (DJBC) has implemented AI-powered chatbots on their website and WhatsApp that can answer basic import questions:

- Document requirements for specific product categories

- Current duty rates for given HS codes

- Port operating hours and holiday schedules

- Basic procedural questions about clearance processes

- Contact information for specialized services

BKPM Virtual Assistant: The investment board’s AI assistant can help with:

- Regulatory interpretation for import-dependent businesses

- Licensing requirement clarification for various business activities

- Investment incentive information that might affect your import strategy

- Local partner verification procedures

- Compliance deadline reminders 🗓️

Ministry of Trade Query System: This specialized tool helps with:

- Product classification verification with Indonesian authorities

- Import quota availability for restricted products

- Tariff preference eligibility under trade agreements

- Standards and certification requirements by product code

- Historical import data for market research purposes 📈

📊 Private Sector Tools and Services: The Professional’s Edge 🌟

WeFreight Indonesia Import Calculator: This powerful tool helps you estimate the total landed cost of your products in Indonesia:

- Duty and tax calculations based on current rates and your product details

- Logistics cost estimates for various shipping methods and routes

- Documentation fee projections for different clearance scenarios

- Cash flow timing analysis showing when payments will be required

- Comparison tools for evaluating different import strategies 💰

Cekindo Import Compliance Platform: This subscription service offers comprehensive compliance management:

- Regulatory change alerts specific to your product categories

- Document template library with current Indonesian formats

- Compliance checklist generators tailored to your shipments

- Risk assessment tools evaluating potential clearance issues

- Audit preparation materials for customs reviews 📋

Global Trade Management (GTM) Systems: For companies with significant import volumes to Indonesia, specialized GTM software offers:

- Automated document generation using Indonesian templates

- Integrated compliance checking against current regulations

- Duty optimization tools for minimizing costs legally

- Supply chain visibility across all import stages

- Reporting and analytics for import performance tracking 📊

📚 Essential Information Sources: Stay Current and Informed 📰

Official Regulatory Publications: These are your primary sources for authoritative regulatory information:

- Ministry of Trade Official Gazette (Berita Resmi Pemerintah): Updates on trade regulations, import restrictions, and policy changes

- Customs Circulars (Surat Edaran Bea Cukai): Detailed implementation guidelines for customs procedures

- Ministry of Finance Regulations (Peraturan Menteri Keuangan): Updates on duty rates, taxes, and customs valuation methods

- BKPM Policy Updates: Changes affecting investment-related import activities

- Industry-Specific Regulations: Publications from sectoral ministries (Health, Industry, Agriculture, etc.) 📑

Trade Association Resources: Industry-specific associations provide valuable sector intelligence:

- American Chamber of Commerce in Indonesia (AmCham): U.S.-specific trade guidance and networking

- European Business Network (EBN): EU-focused regulatory updates and compliance support

- Indonesia International Chamber of Commerce (KADIN): Local business perspectives and advocacy

- Product-Specific Associations: Textiles, electronics, food, and other sector groups with Indonesia expertise

- Logistics Provider Publications: Industry insights from companies with on-the-ground experience 🤝

News and Analysis Services: Stay current with timely market intelligence:

- The Jakarta Post: English-language daily with comprehensive business coverage

- Bisnis Indonesia: Leading business daily with English-language sections

- Reuters Indonesia: International perspective on Indonesian trade developments

- Indonesia Investments: Specialized economic and business analysis

- World Bank Indonesia Reports: Authoritative economic and trade analysis (World Bank, 2025) 📰

📱 Mobile Apps and On-the-Go Resources 🚀

Indonesia Customs Mobile App: The official DJBC application offers:

- Shipment status tracking with real-time updates

- Port and airport operating information including holiday schedules

- Duty calculator for quick estimates

- Contact directory for customs offices nationwide

- Regulatory news feed with the latest updates 📱

Logistics Provider Apps: Major international logistics companies offer Indonesia-specific features:

- Shipment tracking with Indonesian customs status updates

- Document scanning and submission capabilities

- Delivery scheduling tools for Indonesian destinations

- Payment processing for duties and fees

- Customer service chat with Indonesian specialists 📦

Currency Exchange Apps: Indonesia’s currency regulations make real-time exchange monitoring essential:

- Bank Indonesia rates for official conversion calculations

- Market rate trends affecting import profitability

- Historical rate data for financial planning

- Currency risk alerts for significant movements

- Payment timing recommendations based on rate forecasts 💱

Building Your Personal Toolkit: The most successful exporters to Indonesia maintain a customized information ecosystem that combines government resources, private sector tools, and personal networks. Here’s how to build yours:

- Start with the essentials: Create accounts on INATRADE and CEISA 4.0

- Subscribe to relevant alerts: Set up notifications for regulatory changes affecting your products

- Join industry associations: Connect with peers who export to Indonesia

- Establish relationships: Build a network of contacts in Indonesian customs and trade

- Invest in specialized tools: Consider GTM systems or compliance platforms for regular exports

- Schedule regular reviews: Monthly check-ins on regulatory changes and market conditions 🔄

The Bottom Line: You don’t have to navigate Indonesia’s complex import landscape alone. By leveraging these digital tools, resources, and information sources, you can transform your approach from reactive to proactive, anticipating challenges before they become costly problems. Remember that knowledge is power in Indonesian imports—and with the right toolkit, you’ll be well-equipped to tap into this exciting market’s enormous potential! 🌏

🚀 How to Scale: From Trial Shipment to Regular Export (Building Your Indonesia Business) 📈

Congratulations! 🎉 You’ve successfully navigated your first export shipment to Indonesia—no small feat given the complex regulatory environment. But now what? How do you transform this initial success into a sustainable, scalable export operation that generates consistent revenue and growth? In this final section, we’ll explore the strategic pathway from initial exporter to established player in the Indonesian market. Let’s build your growth blueprint! 📋

🤝 Building Trust and Credibility with Indonesian Partners 🌟

The Foundation of Long-Term Success: In Indonesian business culture, trust isn’t just important—it’s everything. Unlike many Western markets where transactions can be purely commercial, Indonesian business relationships thrive on personal connections, mutual respect, and long-term thinking. Your first successful shipment is just the beginning of building this critical foundation. 🤝

Strategies for Building Trust:

- Consistent reliability: Deliver what you promise, when you promise it, every single time

- Transparent communication: Be upfront about challenges, delays, or issues

- Cultural sensitivity: Learn basic Indonesian etiquette and business norms

- Face-to-face meetings: Visit Indonesia regularly to strengthen relationships

- Long-term perspective: Show commitment beyond immediate transactions 🌍

Working Effectively with Your PPJK: Your customs services provider is more than just a service vendor—they’re your operational partner in Indonesia. To build a strong relationship:

- Provide complete, accurate information well in advance of shipments

- Communicate proactively about upcoming shipments or changes

- Respect their professional advice on regulatory matters

- Pay promptly and according to agreed terms

- Provide feedback on their service to help them improve 📞

Developing Indonesian Business Networks: As you grow, expanding your network beyond your immediate PPJK becomes increasingly valuable:

- Industry associations related to your product categories

- Chambers of commerce with Indonesia focus (AmCham, EuroCham, etc.)

- Trade shows and exhibitions in Indonesia

- Business matchmaking events organized by BKPM or local governments

- Online professional networks with Indonesia trade focus 🤝

The Power of Local Representation: For serious scaling, consider establishing a local presence in Indonesia. Options include:

- Hiring a local representative or agent who understands your industry

- Opening a representative office for marketing and relationship building

- Forming a joint venture with an Indonesian company

- Establishing a foreign-owned company (PT PMA) for full market operations

- Working with an exclusive distributor who has national reach 🏢

🌏 Leveraging Indonesia’s ASEAN Trade Corridor Opportunities 🚢

Beyond Indonesia’s Borders: One of the most powerful advantages of establishing a foothold in Indonesia is access to the broader ASEAN Economic Community (AEC), which represents a market of over 650 million people across 10 countries. Indonesia’s strategic position and extensive trade agreements make it an excellent base for regional distribution. 🌏

ASEAN Trade Agreements That Benefit Indonesian Importers:

- ASEAN Trade in Goods Agreement (ATIGA): Eliminates tariffs on 99% of goods traded within ASEAN

- ASEAN-Australia-New Zealand Free Trade Agreement (AANZFTA): Reduces barriers with key Pacific markets

- ASEAN-China Free Trade Area (ACFTA): Enhances access to China’s massive market

- ASEAN-India Free Trade Area (AIFTA): Opens opportunities in India’s growing economy

- Regional Comprehensive Economic Partnership (RCEP): World’s largest free trade agreement covering 30% of global GDP 📊

Strategic Approaches to ASEAN Distribution:

- Indonesia as regional hub: Use Indonesian facilities for regional distribution

- Harmonized documentation: Leverage ASEAN’s common customs documentation systems

- Integrated logistics: Develop supply chains that serve multiple ASEAN markets efficiently

- Regulatory alignment: Use Indonesia’s compliance as baseline for broader market access

- Cross-border e-commerce: Tap into ASEAN’s growing digital marketplace opportunities 🚢

Operational Considerations for ASEAN Expansion:

- Duty drawback programs that refund duties on re-exported goods

- Free trade zones in Indonesia that offer special incentives for re-export

- Transportation networks connecting Indonesia to other ASEAN markets

- Regulatory differences between ASEAN countries that require local adaptation

- Currency management strategies for multi-currency operations 💱

📊 Preparing for Growth: Systems, Compliance, and Risk Management 🛡️

Scaling Your Operations: As your export volume to Indonesia grows, operational efficiency becomes increasingly important. Consider these strategic investments:

- Integrated systems that connect your ERP with Indonesian logistics and compliance platforms

- Automated documentation generation tailored to Indonesian requirements

- Dedicated Indonesia team with specialized knowledge and experience

- Volume-based negotiations with shipping lines and logistics providers

- Inventory optimization strategies for Indonesian market conditions 📈

Advanced Compliance Management: With growth comes increased regulatory scrutiny. Prepare for:

- Regular customs audits of your import history and valuation practices

- Product certification renewals and updates as standards evolve

- Trade agreement compliance verification for preferential duty treatment

- Transfer pricing documentation if you have related-party transactions

- Environmental and social compliance requirements for sensitive products 🔍

Risk Management Strategies: Protect your growing Indonesia business with:

- Comprehensive insurance coverage including political risk, credit, and business interruption

- Diversified supplier and logistics networks to reduce dependency on single providers

- Contingency planning for regulatory changes, natural disasters, or market disruptions

- Financial hedging strategies for currency and commodity price volatility

- Legal counsel with Indonesian trade law expertise for complex issues 🛡️

📈 Key Performance Indicators for Indonesia Export Success 📊

Measuring What Matters: To effectively scale, you need the right metrics. Track these KPIs for your Indonesia export operations:

Financial Metrics:

- Profit margin by product category (accounting for all Indonesian costs)

- Duty and tax burden as percentage of landed cost

- Days sales outstanding for Indonesian customers

- Total landed cost vs. target selling price

- Return on investment for market development activities 💰

Operational Metrics:

- Average clearance time from port arrival to release

- Documentation accuracy rate (first-time acceptance)

- On-time delivery performance to Indonesian customers

- Inventory turnover for Indonesian market stock

- Order fulfillment cycle time from order to delivery ⏱️

Compliance Metrics:

- Number of customs inspections vs. industry average

- Compliance violation frequency and resolution time

- Certificate maintenance status and renewal rates

- Audit findings and corrective action completion

- Regulatory change response time 📋

Market Development Metrics:

- Market share growth in target Indonesian segments

- Customer acquisition cost and lifetime value

- Brand awareness and perception in Indonesian market

- Distributor/retailer coverage and performance

- Customer satisfaction and retention rates 🌟

🎯 Strategic Pathways for Long-Term Growth 🚀

Option 1: Product Line Expansion: Once you’ve established a foothold with initial products, consider:

- Complementary products that leverage your existing distribution channels

- Product adaptations specifically for Indonesian market preferences

- Premium and value variants to capture different market segments

- Private label opportunities with major Indonesian retailers

- Regional product variants for different Indonesian areas 📦

Option 2: Geographic Expansion: Beyond Jakarta and Surabaya, consider:

- Secondary cities with growing middle-class populations

- Special economic zones with enhanced infrastructure and incentives

- Eastern Indonesia markets with less competition but higher logistics costs

- Cross-border trade areas serving neighboring countries

- Tourism markets with special import allowances 🗺️

Option 3: Business Model Evolution: Transform your approach with:

- Local assembly or manufacturing to reduce import costs and barriers

- E-commerce direct-to-consumer channels bypassing traditional retail

- Subscription or rental models for certain product categories

- Service-based offerings complementing your imported products

- Technology platforms connecting Indonesian buyers with global suppliers 💡

The Bottom Line: Scaling your Indonesia export operation requires strategic thinking beyond individual shipments. By building strong relationships, leveraging regional opportunities, implementing robust systems, and measuring performance effectively, you can transform initial success into sustainable, profitable growth in one of the world’s most dynamic markets.

Remember that Indonesia rewards patience and commitment—companies that take the time to understand the market, build genuine relationships, and invest in long-term operations consistently outperform those seeking quick returns. Your successful first shipment is just the beginning of an exciting journey in Southeast Asia’s largest economy! 🌏

🎯 Ready to Conquer Indonesia’s Import Market? Your Next Steps Start Here! 🚀

You’ve made it through our comprehensive guide to exporting to Indonesia as a non-resident—congratulations! 🎉 By now, you understand that Indonesia’s $150+ billion import market offers enormous potential, but success requires navigating a complex regulatory landscape with precision and expertise. From proper product classification and PPJK selection to documentation mastery and customs clearance, you now have the knowledge to avoid the costly mistakes that trip up so many first-time exporters. 📚

But let’s be honest: reading about Indonesian imports is one thing—executing successfully is another entirely. The difference between profit and disaster often comes down to having the right local expertise and support at every step of the journey. That’s exactly where M2B comes in! 🤝

Why Go It Alone When You Can Have Experts in Your Corner?

At M2B, we’ve helped hundreds of non-resident exporters just like you successfully navigate Indonesia’s complex import landscape. Our end-to-end import solutions are designed specifically for international businesses that want to tap into Indonesia’s booming market without getting bogged down by bureaucracy, documentation nightmares, or costly compliance errors. 💼

Here’s What Makes M2B Different:

✅ Local Expertise, Global Standards: Our team combines deep Indonesian market knowledge with international best practices, ensuring your imports meet all local requirements while maintaining global quality standards. 🌍

✅ Complete Compliance Management: From HS code verification to document preparation and customs clearance, we handle the entire compliance process so you can focus on your core business. No more guessing about regulations or worrying about costly mistakes! 📋

✅ Strategic PPJK Network: We’ve built relationships with Indonesia’s most reliable customs brokers and import specialists, giving you access to vetted professionals who understand your specific industry and product requirements. 🤝

✅ Technology-Driven Processes: Our digital platforms streamline documentation, provide real-time tracking, and ensure complete transparency throughout your import journey—no more wondering where your shipment is or when it will clear customs. 📱

✅ Proactive Problem Solving: We don’t just react to issues—we anticipate them. Our team monitors regulatory changes, identifies potential challenges before they become problems, and develops contingency plans to keep your imports flowing smoothly. 🔍

The M2B Advantage: What Our Clients Experience

When you partner with M2B for your Indonesian imports, you can expect:

- Faster clearance times (50-70% reduction vs. industry average)

- Reduced compliance costs through optimized duty structures and documentation

- Peace of mind knowing experts are managing your regulatory requirements

- Scalable solutions that grow with your business in Indonesia

- Single point of contact for all your import needs, eliminating coordination headaches 🚀

Ready to Transform Your Indonesia Import Strategy?

Don’t let complexity hold you back from one of the world’s most exciting growth markets! Take the first step toward Indonesian import success today with M2B’s comprehensive support system. We’re offering a complimentary 30-minute consultation to discuss your specific products, challenges, and opportunities in the Indonesian market—absolutely free and with no obligation. 🗓️

During Your Free Consultation, You’ll Receive:

- Personalized compliance assessment for your specific product categories

- Custom duty calculation based on current Indonesian rates and your product details

- Risk analysis identifying potential challenges and solutions

- Strategic roadmap for your Indonesia import operations

- Answers to your pressing questions about Indonesian import requirements 💡

Plus, as a special bonus, you’ll get instant access to our exclusive:

📋 “Indonesia Import Compliance Checklist: The Non-Resident’s Guide to Flawless Shipments”

This comprehensive checklist covers every critical step in the Indonesian import process, from initial product classification to final delivery. It’s the perfect reference tool to ensure you never miss a critical requirement or deadline—a $297 value, yours free when you book your consultation today! 🎁

Your Indonesia Import Success Story Starts Now!

The Indonesian market is waiting, and with M2B as your partner, you have everything you need to succeed. Don’t let regulatory complexity keep you from tapping into this incredible opportunity. Whether you’re planning your first shipment or looking to scale existing operations, we’re here to make your Indonesia import journey smooth, profitable, and stress-free. 🌟

👉 Click Here to Schedule Your Free Indonesia Import Consultation and Get Your Compliance Checklist!

Schedule Your Free Consultation Now

Still Have Questions? We’re here to help! Contact our Indonesia trade specialists at:

📧 Email: info@m2b.co.id 📱 ** WhatsApp:** +62 812-6302-7818 🌐 Website: www.m2b.co.id/

Remember: Every day you delay is a day your competitors are gaining ground in Indonesia’s massive market. Take action now and position your business for the incredible growth that awaits in Southeast Asia’s economic powerhouse! 🚀🌏

We look forward to helping you write your own Indonesia import success story! The M2B Indonesia Trade Team 🇮🇩💼

References

Indonesia Trade. (2025). INATRADE – Indonesia National Trade System. Ministry of Trade of the Republic of Indonesia. Retrieved from https://www.inatrade.go.id

Indonesian Customs. (2025). Annual Enforcement Report 2025. Directorate General of Customs and Excise. Retrieved from https://www.beacukai.go.id

Ministry of Finance. (2025). Regulation No. 25/2025 on Customs Valuation for Transferred Goods. Ministry of Finance of the Republic of Indonesia. Retrieved from https://www.finance.go.id

Ministry of Trade. (2025). Regulation No. 16/2025 on Import Provisions and Procedures. Ministry of Trade of the Republic of Indonesia. Retrieved from https://www.tradeministry.go.id

World Bank. (2025). Indonesia Trade Monitor: July 2025 Update. World Bank Group. Retrieved from https://www.worldbank.org