Introduction

Exporting mineral products and metals into Indonesia (or working with Indonesian-origin material) presents significant opportunities — but also equally significant challenges. For companies in the freight-forwarding, logistics, and customs brokerage business (like yours with PT Mora Multi Berkah / “M2B”), understanding the regulatory, commercial, and operational landscape is critical. In this article I’ll walk you through the key challenges, current regulatory-trends, and actionable tips to succeed. 😉

1. Why Indonesia matters in minerals & metals trade

6

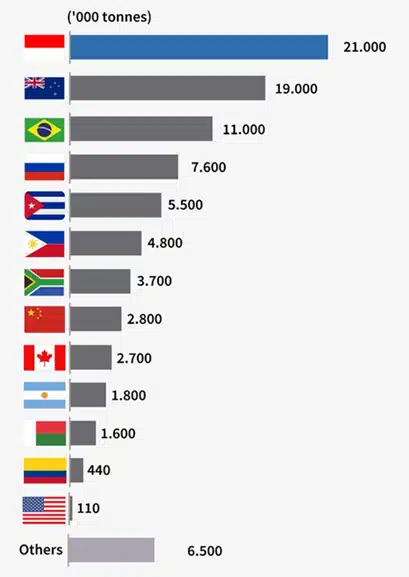

- Indonesia is a major global player in minerals like nickel (used in EV batteries) and copper. id.crifasia.com+3Wikipedia+3globalasia.org+3

- The government has shifted policy from raw-ore export towards downstream (processing) value-addition. id.crifasia.com+2globalasia.org+2

- This means exporters (and logistics / customs brokers) must be aligned with changing rules, higher processing requirements, and value-chain shifts (which opens opportunities for logistics value-add).

2. Key challenges to exporting mineral products & metals into/through Indonesia

Here are the major hurdles — keep in mind: these are not blockers per se, but risk-factors to manage.

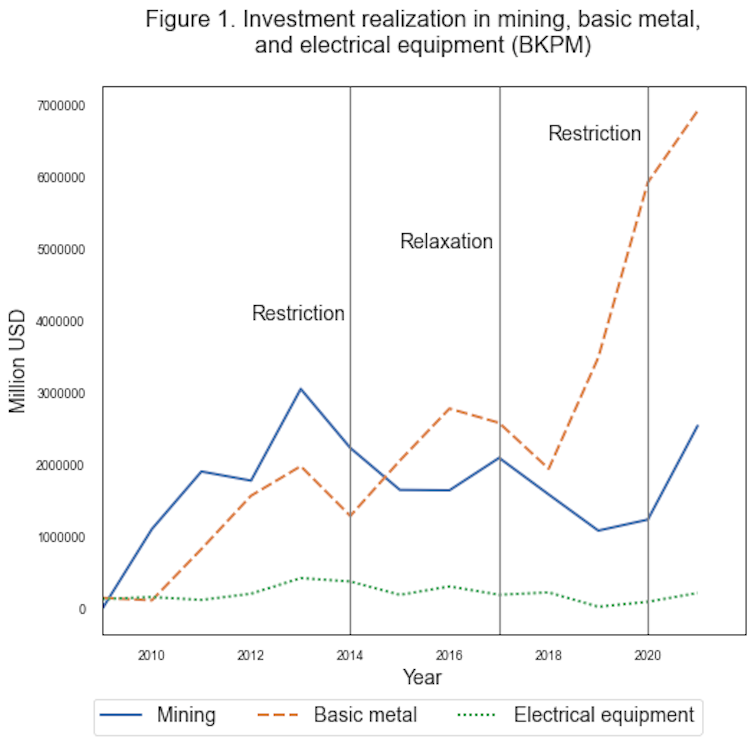

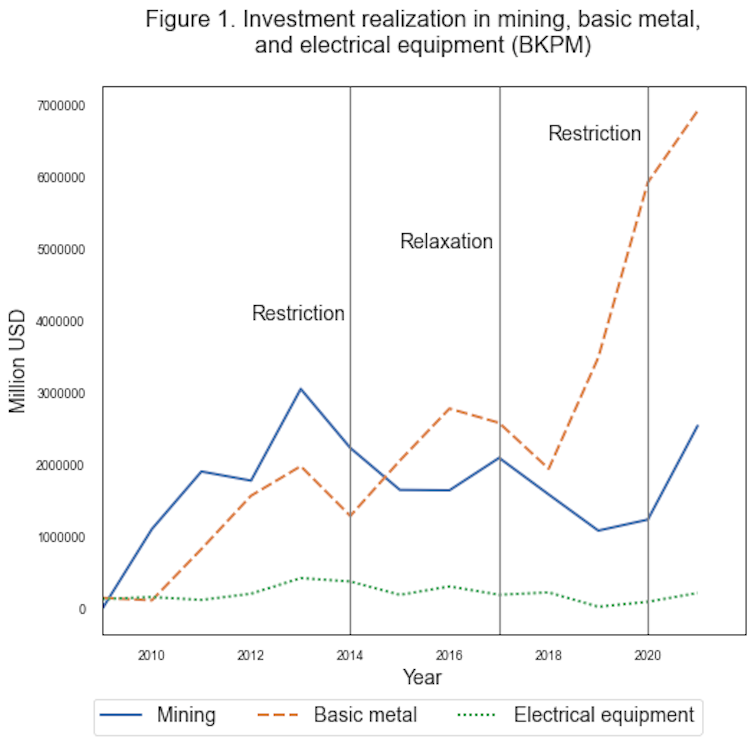

a) Export restrictions / bans & downstream requirements

6

- Indonesia has imposed bans on raw mineral exports (for example nickel ore) in an effort to promote local processing. World Bank Blogs+2globalasia.org+2

- A study shows that export taxes and tariffs on raw materials discourage their exports and encourage exports of processed mineral products. Neliti

- This creates a challenge for exporters who rely on “raw product” flows: the regulatory risk is real; upstream raw may be prohibited or subject to heavy tariff / tax.

b) Uncertainty & regulatory change

6

- Because policies are actively evolving (e.g., mining law amendments, export ban enforcement) the trade environment is dynamic. Reuters+1

- For exporters and logistics providers, this means: your risk mitigation must account for sudden regulatory shifts, changed export/processing rules, local partner compliance.

- Also enforcement may vary by province, material, and end-use category (whether raw, concentrate, processed metal).

c) Value-chain and processing pressure

6

- Indonesia is pushing for more downstream value-addition (turning ore into refined metal, or battery-grade materials) rather than merely exporting unprocessed commodities. globalasia.org+1

- If your business model is to export raw mineral to Indonesia (or import from Indonesia), you must check whether your product qualifies under allowed flows (raw vs processed), and whether the Indonesian party has required processing/smelter capacity or license.

- Logistics and customs processes will be influenced: ports, handling of processed vs raw, export permits, local content rules.

d) Compliance, licensing, and documentation complexity

- Exporters must ensure they understand: origin certificates, HS codes (for metals and minerals), local Indonesian mining licences, smelter permits, export quotas/permits when applicable.

- Shared risk: delays, misclassification, or non-compliance may lead to shipment being held, extra duties, or denied entry/exit.

- Environmental and community / social compliance are under stronger scrutiny (particularly for mining/mineral flows).

e) Logistics, supply chain and cost factors

- Moving minerals/metals often involves bulk, heavy tonnage, special handling (hazardous classification in some cases), specialised ports, risk of theft/damage/corrosion.

- Given Indonesia’s archipelagic geography, inland logistics from mine site to port (or processing plant) may add cost/time/risk.

- For a freight forwarder / customs broker (such as M2B), you must build robust network + insurance + transit/handling controls.

- Also tariff/ duty/ export tax structures (for raw vs processed) may alter your landing cost projections.

3. Practical Tips for Success (for Exporters & Logistics Providers)

🎯 Let’s turn challenges into actionable items — so that M2B (and its clients) can be ahead of the game.

Tip 1 – Map the value‐chain & product format

- Clarify what you are exporting: raw ore? concentrate? refined metal? alloy? This matters. For example, raw nickel ore export from Indonesia has been banned or heavily restricted. US International Trade Commission+1

- Check HS code and classification for your product.

- Check whether Indonesia requires local processing for your material type. If yes, partner with Indonesian company that has a smelter-licence or authority to receive processed material.

- Build logistics flow accordingly: mine → transport → port → shipping → final destination. Each leg has risk.

Tip 2 – Ensure regulatory & compliance readiness

- Stay updated on Indonesian laws / amendments (e.g., mining law, export ban terms, value-addition rules).

- Ensure your Indonesian counterpart has valid licences, smelter status (if required), and compliance with local environmental/social/ownership rules.

- Document everything: export permits, customs paperwork, origin certificates, local Indonesian partner documents.

- Work with a customs brokerage (you already have that expertise) to ensure you capture all duties/tariffs/fees and avoid surprise delays.

Tip 3 – Leverage your logistics & freight forwarder advantage

- As a freight forwarder + logistics company (that’s you, M2B) emphasise your full-service capability: door-to-port, port-to-port, customs clearance, permit tracking, risk mitigation.

- Offer to clients value-added services: local Indonesian permit liaison, smelter logistics, consolidated shipments if tonnage is low, secure transport for high-value metal shipments.

- Keep track of cost drivers: inland haulage in Indonesia can be more expensive; remote mine-site may require barging, small ports.

- Consider transit time, storage risk, commodity price fluctuations (metals/minerals move with cycles) — counsel your clients accordingly.

Tip 4 – Partner wisely & establish local intelligence

- Partner with Indonesian local agents who know local mining authorities, smelter licensing, export permit processes.

- Have a process to monitor Indonesian policy environment (ban proposals, permit changes, downstream incentives) — so you can anticipate changes rather than react.

- Build scenario-planning: e.g., what if export bans tighten? What if your raw material suddenly needs a domestic smelter?

Tip 5 – Communicate value to clients & manage expectations

- For clients wishing to export mineral/metal products into Indonesia, make clear the added complexity (and cost/time) compared to standard commodity export.

- Lay out clear timelines and potential regulatory bottlenecks.

- Highlight your differentiators: your customs expertise, your freight-forwarding network, your ability to coordinate with Indonesian authorities.

- Use content/marketing (blog posts, white papers) to show how M2B “speaks the language” of mining exports and Indonesian rules — this builds trust and positions the company as the go-to logistics partner.

4. Current Trend Watch 🔍

- Indonesia is accelerating its downstream metal processing industry (refineries, smelters) to capture more value domestically. globalasia.org+1

- Global attention on “critical minerals” (nickel, copper, cobalt, etc) means Indonesia’s role is strategic — so supply chain risk, geopolitics, and sustainability (ESG) are all more visible. CSIS Journals+1

- Export quotas, bans, environmental regulation, smelter‐licensing are part of the new normal for mineral/metal flows in Indonesia.

- For logistics providers: increased demand for secure, compliant freight operations, especially for high-value metal shipments, plus demand for transparency (ESG tracking, chain of custody).

- Opportunity for value-added services: not just shipping cargo, but managing permits, processing partners, downstream logistic flows.

5. Why partner with M2B – Your Logistics | Solution | Partner

If you (as exporter) are looking for a trusted partner to handle logistics and customs for mineral/metal shipments into or out of Indonesia, here’s how M2B can help:

- End-to-end freight forwarding: from mine-site pickup to port to final export/import clearance.

- Customs brokerage expertise in Indonesia and overseas import/export flows.

- Deep understanding of Indonesian mineral/metal trade regulatory environment.

- Risk mitigation: we monitor licensing, export bans, smelter requirements, document compliance.

- Transparent pricing and cost projection so you avoid hidden surprises.

📞 Get in touch:

- Website: www.m2b.co.id

- Email: info@m2b.co.id

- Phone / WhatsApp: +62 812 6302 7818

6. Conclusion

Exporting mineral products and metals into or through Indonesia is not a plug-and-play scenario. The regulatory, logistical and value-chain complexities require a competent partner and a strategy tuned to the local environment. However—with the right preparation and a strong logistics/back-office partner like M2B—you can turn these challenges into competitive advantage.

If you’d like to discuss how M2B can support your next mineral/metal shipment, or how to set up compliance & logistics structure for Indonesia, let’s talk. 🚀

Call to Action: If you’re ready to explore or execute mineral/metal export into Indonesia, connect with the M2B team now at www.m2b.co.id / info@m2b.co.id / +62 812 6302 7818. Let’s make your supply chain smooth, compliant and ready for growth.